Frequently Asked Questions

Are Undergraduate classes taxable for dependents?

If the dependent cannot be claimed on the employee’s current year federal tax return, then undergraduate dependent tuition is taxable.

Claiming Exempt on W-4 - Expiration of Exempt

A Form W-4 claiming exemption from withholding is effective when it is submitted to the employer and only for that calendar year. To continue to be exempt from withholding, an employee must submit a new Form W-4 via Employee Self Service by February 15. If the employee fails to submit a new Form W-4 by February 15, we will begin withholding as if the employee had checked the box for Single or Married filing separately in Step 1(c) and made no entries in Step 2, Step 3, or Step 4 of the 2020 Form W-4.

NOTE: If the employee provides a new Form W-4 claiming exemption from withholding on February 16 or later, it will be applied to future wages, we will not refund any taxes withheld while the exempt status wasn’t in place.

What happens if I purchase airfare outside of CTP/Concur?

If you purchased airfare outside of CTP/Concur after Aug. 1, 2018, you ultimately will not be reimbursed for that cost.

In the first two instances that you buy airfare outside of the policy, the travel office will send an email to you, your supervisor and the fiscal officer in your area that reiterates the policy. In the third instance, the university will not reimburse you for the cost of your airfare.

*Group and Athletic Team/Individual travel must be booked through the contracted agency designated for these demographics - see more information.

Can I donate/sell assets that no longer have a useful life?

Please refer to the Dean or Vice President of your college and the OSU Surplus Department.

Where can I get a COVID-19 vaccine?

You can walk in for an appointment today or schedule one on Ohio State’s Columbus campus or at Wexner Medical Center locations around central Ohio at no cost to you.

There are also sites throughout the state of Ohio, including in the communities in which the university’s campuses are located, so it is easy to find a location near you.

How do I add a new supplier?

Ohio State end users with access to create requisitions must submit a non-catalog purchase requisition without a supplier. More information for creating the new supplier can be found in the Creating a Supplier Record job aid. In addition, requisitions without a supplier will be further vetted by Service Centers/Buyers, Commodity Managers, and Supplier Administrators. The Supplier Administrator will invite the new prospective supplier after the request has been approved. Once the supplier completes registration and the Supplier Administrator team screens the supplier, the supplier will be created in Workday and the requisition will be fulfilled.

Can I combine personal travel with a business trip?

Travelers may combine personal travel with a business trip, but should consult with their supervisor before initiating arrangements. When arranging travel in these instances, travelers must ensure that arrangements are made in such a way that stewardship of university resources and administrative time is the priority. Travelers incurring additional costs by taking personal travel in conjunction with business travel must pay for the costs of travel and other expenses with personal funds and request reimbursement for the business travel costs. Travel expenses to and from alternate vacation destinations occurring before, during, or after university business travel are not eligible for payment with university procurement methods. In cases when personal travel is added to university business travel, any cost variance in expenses such as airfare, vehicle rental, and/or lodging must be clearly identified and documented in Workday, to validate that the vacation time does not add additional cost to the university.

When do I have access to my money?

Your net pay will be deposited by the opening of business on the morning of payday and the full amount deposited is immediately available in your account

I have reviewed the information available here on the payroll website and in HR Connection via the link provided below and still have questions about my taxes. Who do I contact?

Contact HR Connection by submitting a Tax Inquiry through HR Connection, email hrconnection@osu.edu, or call 614-247-myHR (6947).

Is there a Concur mobile app?

Although Concur does offer a mobile app, it is not recommended for use by OSU employees for booking business travel. The Concur mobile app does not offer the security features for personal devices that would be standard for OSU. All airfare (hotel, car...) bookings should be made through the Concur online access at: OSU Travel – Book Travel Online.

Does the university use internal or external fund managers?

The Office of Investments determines the investment strategy for the LTIP, makes asset allocation decisions and places investments with external fund managers.

The university selects investment managers based on their record of success, alignment with our strategic investment priorities and approach to risk.

What documentation do I need accompany a religious or medical exemption request?

If you are requesting a religious exemption, the explanation portion of the exemption request form needs to be notarized. For a medical exemption request, along with a completed exemption request form, you need to provide documentation from your treating licensed practitioner (e.g. physician, advanced practice provider, CNP) specifying the health-related contraindication, including allergic reaction to an ingredient in a COVID-19 vaccine and/or history of allergic reactions to other vaccines or other medical injections. Documentation must be signed and dated by the licensed practitioner, indicating which COVID-19 vaccine you are not able to receive.

Can a Spend Authorization that has been closed be reopened?

No. The cancellation or closure of the Spend Authorization is a permanent action that cannot be reopened. Any remaining Expense Reports to be processed will need to reference the associated Spend Authorization number in the comments.

Why do I have to use the university’s contracted travel agencies to be eligible for OSU’s airline discounts?

Applying the discount to the fare reservation is limited to the GDS (Global Distribution System) associated with the travel agency, which permits the airline to connect the purchase to OSU. As the OSU business spend increases, the university can leverage more substantial discounts in the future.

How do I get a printed copy of the university's Financial Report?

Contact Tricia Privette at (614) 688-3728 or Privette.3@osu.edu. If you would like to be added to the annual mailing list, please indicate this.

If I'm required to wear certain clothing for work, why must I pay tax on it?

The IRS requires us to tax all items given to an employee unless there is a defined exclusion. Clothing must meet the IRS rules for exclusion to be treated as non-taxable.

Biweekly Payslip Earnings

Regular base wages are reported as Hourly Pay.

Additional premium pay amounts for shift differential, weekend differential, certification pay, clinical ladder pay, charge pay, and overpercent are reported as a separate line item from the base hourly, time off, holiday, and overtime wages.

For the Overtime and Holiday Worked earning types, the hourly rate displayed on the payslip will not reflect the rate that was used to calculate the payment. The base hourly rate will display on the payslip, but the dollar amounts for Overtime and Holiday Worked earnings will calculate based on the premium hourly rate for each earning type. This is a display nuance only and does not impact net pay.

All employees who receive Certification Pay will see it displayed separately as its own line item.

For those receiving Clinical Ladder pay, the payment will display as an allowance earning separate from Hourly Pay.

If an earning type appears multiple times in the “Hours and Earnings” section, employees will only see the YTD Amount value for that earning type displayed on one line. The amount shown will be the total of all earnings from that earning type.

For One-Time Payments, such as a bonus or other lump sum payment types, employees will see dates in the Hours and Earnings section of their payslip. Although these dates may differ from the Pay Period Begin and End dates, the payment will be paid in full on the payslip check date. The dates that appear in this section of the payslip for One-Time Payments do not have any impact on the payment or the employee. For more information about the One-Time Payment, visit your Worker Profile, click Job, then Worker History. Click View Worker History by Category, and then click on the Compensation tab.

Employees with multiple positions will not see YTD Hour values in the “Hours and Earnings” section of the payslip.

GTP said that I'm a Resident Alien so I want a refund of my GTP purchase price.

As indicated on the Individual Use Sales page, you are asked to enter information about your tax status so that we may determine whether GTP is the right product for you. Based on the information you entered, you were determined to be a nonresident alien. It appears that you entered different information from what you provided to us at the time of purchase so we will not provide a refund.

Does the University have automobile insurance?

All University owned and when required by contract leased or borrowed vehicles are covered by the University's insurance program. If driving your personal vehicle, auto insurance follows the owner of the auto. If you are using your personal auto for university business, your insurance policy is primary.

About U.S. Taxes

The United States has several different sets of tax laws. Federal tax law applies to taxes paid to the United States government. State tax laws apply to taxes paid to the state in which you work and/or live. In some places there may also be local or city taxes. It is important to comply with all federal, state, and local tax laws that apply to you.

The federal and state tax system is based on a graduated tax system, which means that the percentage of tax a person pays is dependent on the amount of income they earn and the number of dependents they have (nonresident aliens can only claim one dependent, unless they are a resident of Canada, Mexico, South Korea or student from India). If you earn a smaller income, you pay a smaller percentage in tax, but if you earn a larger salary, you pay a higher percentage. The local or city taxes (work location) are not on a graduated tax system. Most local taxes are withheld based on a fixed percentage. For example, Columbus taxes are a fixed 2.5 percent.

What additional information should I know about the reimbursement of temporary childcare costs?

Q: Who is eligible for reimbursement of temporary childcare costs?

A: Employees traveling to a conference for 5 or more consecutive days and have temporary childcare costs pre-authorized with a Spend Authorization are eligible for reimbursement for childcare expenses that are above and beyond normal childcare costs.

Q: How is a child defined?

A: The Travel Policy defines a child as a biological, adoptive, step, or foster child; a legal ward; or a child of a person standing in loco parentis, who resides with the traveler.

Q: How is a conference defined?

A: The Travel Policy defines a conference as a retreat, seminar, symposium, workshop, or event whose primary purpose is the dissemination of information beyond the university and is necessary and reasonable to further successful performance. It would include a formal agenda or schedule and includes individuals from many different entities.

Q: How do I obtain pre-approval for temporary childcare costs?

A: Pre-approval is obtained through the Spend Authorization process. Additional approval requirements may exist if using sponsored grant funding.

Q: Are travel days included in eligibility for temporary childcare costs?

A: Travel days are not eligible for reimbursement of temporary childcare costs.

Q: What constitutes “above and beyond” normal childcare costs?

A: “Above and beyond” childcare costs are those that are beyond the normal cost incurred for childcare when not in business travel status for the conference travel duration. See example below:

Example: Employee traveler sends their child to childcare during the normal business week (Monday-Friday, 8 a.m.-5 p.m.) This timeframe would NOT be above and beyond normal childcare costs and would not be eligible for reimbursement.

Q: What documentation is required to process a reimbursement of temporary childcare expenses?

A: Receipt (or equivalent documentation) must be attached to the Expense Report to document payment, hours of service, number of children, etc. In addition, the conference agenda should be included to document eligible timeframe committed to conference related duties.

Q: Is reimbursement permitted if an immediate family member provides temporary childcare?

A: No, temporary childcare services must be provided by a licensed, independent third party. The traveler must pay for the services with personal resources and submit for reimbursement with an itemized receipt (or equivalent documentation).

Q: What expense item should I use for temporary childcare costs when submitting for reimbursement?

A: “Travel Childcare Costs” is the expense item used for temporary childcare costs when entering an Expense Report for reimbursement.

Q: Who is responsible for reporting the tax benefits for temporary childcare that has been reimbursed?

A: The unit is responsible for submitting the applicable one-time payment request in Workday on behalf of the employee traveler. See Initiating One–Time Payments for Taxable Items job aid in the Administrative Resource Center.

Q: What if my circumstances don’t fit the eligibility criteria?

A: An exception request must be submitted for review by the Office of Business and Finance and the Office of Academic Affairs. Send requests to Lisa Plaga (plaga.5@osu.edu).

Where can I find more information about Sponsored Travel?

The travel section of the Office of Sponsored Programs website may be found at the Office of Sponsored Programs website. For more detailed information, contact the Office of Sponsored Programs Travel Office at 614-292-2126 or to OR-travel@osu.edu.

Will paper monthly reports be distributed from the PeopleSoft general ledger?

No. You may access and print your reports using the eReports server.

Why am I being taxed for an item I received?

IRS requires us to tax all items unless there is a defined exclusion.

Form 1040NR, U.S. Nonresident Alien Income Tax Return

This form is used by nonresident taxpayers to file an annual income tax return.

My spouse is also in the U.S. and works or receives income too. Does he or she have to file a separate tax return or can I just add both of our incomes together and file one tax return?

Nonresident Aliens are not allowed to claim a joint tax return. As such, EACH Nonresident Alien who receives ANY income from U.S. sources must file an income tax return. Therefore, if you have a spouse who works and/or receives any income, he or she must file an income tax return that is separate from you – you may not combine your income on one tax return.

How do I get back the federal and state taxes that were withheld if I have no filing requirement?

You will have to submit federal and state tax returns to obtain a refund of the taxes withheld.

Nonresident alien for Tax Purposes

Federal

If you are in F, J or H status and a nonresident alien for tax purposes:

If you received U.S. source income in the current calendar year, you are required to file a federal tax return with the IRS (Internal Revue Service). You must complete and mail IRS Form 1040-NR and IRS Form 8843. You must file a federal tax return form even if your employer deducted ("withheld") money from your paycheck for federal taxes. The amount that is deducted from your paychecks is an estimated amount, so you may in fact, owe tax if an insufficient amount was withheld based on the IRS standard amounts. If the estimated amount deducted from your paychecks is higher than what you should have paid based on the IRS standard, you may receive a refund of taxes. Therefore, you must file a tax form to calculate the difference between what you owe and what you paid. Even if a tax treaty was applied to your paychecks during the year and the amount you owe in taxes is reduced or eliminated, you are still required to file a federal tax return with the IRS. You would file IRS Form 1040-NR and Form 8843. The GLACIER Tax Prep link on the Glacier system will provide these forms, if applicable. Not filing a tax return is a violation of U.S. tax law.

Filing tax documents each year is an important part of maintaining your immigration status and is a federal requirement for international visitors and their dependents. Not filing your required taxes documents could lead to penalties, such as a fine, or even negatively impact your immigration status.

If you apply for future immigration benefits, such as H-1B, Permanent Residency, or other statuses, you will likely be asked to provide copies of tax filings for all previous years you were in the U.S. If you forgot or didn't file in previous years when you should have, the IRS recommends that you file now for previous years. You can find the relevant forms from past years on the IRS website. The IRS expects you to file your taxes each year--even if you file late. Penalties for late filing may include fines, interest on taxes owed, or other consequences.

Form 8843

IRS Form 8843 is a tax form used by foreign nationals to document the number of days spent outside of the U.S. and to help determine tax responsibility. All F and J foreign nationals (and their F-2/J-2 dependents) who are nonresident aliens for tax purposes are required to file Form 8843. You will file this form whether or not you received income or are filing a tax return. You must file Form 8843 if BOTH of the following conditions are met:

- You were present in the U.S. in F/J status for any portion of the previous calendar year (the year for which you are filing)

- You are a nonresident alien for tax purposes.

Dependents (including children, regardless of age) should complete a separate Form 8843 independent of the F-1/J-1.

State

Some international students and scholars are required to file a State of Ohio Tax Form: http://tax.ohio.gov/. If you worked in more than one U.S. state during the past calendar year, you may have to file tax returns in all the states in which you resided or worked. You should check the state revenue website of the other state(s) where you worked or lived for assistance in determining your tax filing obligations. The GLACIER Tax Prep link on the Glacier system only provides assistance with the Federal tax return.

City/Local

Some cities require completion of a tax return for all residents. You should check with the city you live in.

If I am a Sender and I need to route an envelope to a 3rd person, does that line need to be in the template?

Yes. The Template should include every role needed for a Sender to use as is.

How long will it take for my payment to be deposited into my bank account?

You should allow at least 3-5 business days for your bank to deposit the payment into your account from the time you receive the email confirmation.

Why Didn't GTP ask me about my bank account interest?

For nonresident aliens, interest from a U.S. savings and/or checking account is not considered to be income to you and is therefore not taxable or reportable. If your bank or financial institution did report interest from a savings and/or checking account to you, you may have received a Form 1099-INT. If so, check the Form 1099-INT box and you will be prompted to fill in the Form 1099-INT on the screen. However, if you did not receive a Form 1099-INT (as you should not because you are a nonresident alien), there is nothing to report on your Form 1040NR or 1040NR-EZ. Also, you may have received a Form 1042-S with an Income Code 29. You do not need to input a Form 1042-S with an Income Code 29 into GTP because the interest income is not taxable to a nonresident alien.

What is a disruption?

An event that interrupts normal business functions and operations, whether anticipated (e.g., flood, tornado) or unanticipated (e.g., blackout, technology failure).

Can we get a copy of the Policy?

Yes. The eSignature Policy is available at the bottom of the DocuSign Home Tab (Look for - eSignature Policy) and the University Policy website.

I have a payment for an employee who terminated or retired. Will their payment be distributed as a direct deposit?

Contact Payroll for questions.

How do I obtain a certificate of completion?

A learner must attend a course in its entirety to be eligible to receive a workshop certificate. After completing the course, access BuckyeLearn to download or print a certificate.

If I have a fraudulent transaction on my PCard, do I still need to submit an expense report?

Yes, you must still submit an expense report even if a transaction is in dispute. The expense report should be submitted within 7 days of the transaction load into Workday. Select PCard - Disputed Transaction or Dispute Credit as the business purpose and Disputed Credit Card Transactions as the expense item type on the line of the expense report. You also must attach a copy of the Dispute Form to the associated Expense Report

What is the retail order period?

The retail order period gives retail investors an opportunity to place orders on a first priority basis.

Are Graduate classes for dependents taxable?

Yes. All graduate classes for dependents are taxable. There is no exempt amount for dependent tuition benefits.

Work State and Work Local Tax Withholdings

The University is responsible for accurately withholding your state and/or local income tax based on your actual work location(s). It is your responsibility, in partnership with your manager, to ensure your work location(s) on record is accurate and up to date.

Due to the pandemic, Ohio legislature passed legislation on March 27, 2020, addressing income tax issues for out-of-state employers with employees now working remotely in Ohio. House Bill 197 suspended the impact of municipal taxes based on the location of work, and Ohio State will track and report taxes based on each employee’s approved work locations as required by law.

Ohio House Bill 110 was passed on June 28, 2021, extending the temporary municipal tax rule through December 31, 2021. As a result, work locations prior to the pandemic are effective for tax purposes until work location changes submitted via Flex Work Agreement are reflected on paychecks by the first paycheck of 2022.

If you are working fully remote or have a hybrid arrangement, working remote and on campus, report your work location(s) now by completing the electronic Flexible Work Agreement in HR Connection.

In the event there is a request for flexible work arrangements that involve an out of state location, because employment laws differ in each state, careful consideration must be given before seeking approval for these arrangements, including the loss of income to the state of Ohio.

More information regarding the Flexible Work Agreement form in HR Connection is available on the HR website.

State Tax Reciprocity

State tax for the work location is required to be withheld.

- Working in Ohio but claiming permanent residency reciprocity for Kentucky, Michigan or West Virginia. Complete the IT-4.

- Working in Ohio but claiming permanent residency reciprocity for Indiana or Pennsylvania. Complete the IT-4 and the appropriate state form since your state of residency tax will be withheld.

For further assistance, go to HR Connection

Can I use my PCard for airfare purchases?

No. Airfare must be purchased through a CTP full-service agent or Concur using the preloaded cards applicable to business travel. PCards issued to Ohio State employees cannot be used to purchase airfare from any source and will be audited to the same compliance review as airfare purchase. Failure to comply may result in the revocation of the PCard.

*Group and Athletic Team/Individual travel must be booked through the contracted agency designated for these demographics - see more information.

Will there be a requirement to get a third dose of the COVID-19 vaccine?

At this time, third doses are available for some populations but those doses are not required in order to meet the university’s requirement.

Additional requirements may be added to the Non-Discretionary Vaccine Policy based on guidance issued in the future by the CDC and FDA.

What documentation do I need if I will be combining business travel with personal travel?

When combining personal travel with business travel, only those expenses directly related to the business travel can be paid/reimbursed by the university. Travelers must ensure that all business related and vacation expense variances are clearly documented and available for audit review. It is best practice to keep all business related expenses separated when possible; this ensures that documentation is as clear as possible. When this cannot be done (e.g. Airfare), cost comparisons should be done to show the pricing differences as if only business time was included. Cost comparisons should be conducted at the same time the expenditure of funds occurs and must be clearly documented and available for audit review. Expenses such as parking and Per Diem will be prorated and limited to only the business travel date/time.

What is the privacy policy of Arctic International LLC and GTP?

Arctic International LLC (”Arctic”) is the owner of GTP. Arctic agrees that all data entered into GTP and stored on our secure servers is for use only in connection with your use of GTP. Arctic will not use, disclose, sell, distribute, or otherwise make available any data related to a user for any purpose except and only as necessary in connection with the operation of GTP and the preparation of any applicable federal tax forms. Arctic, however, will respond to any subpoena and will cooperate with any legal or governmental proceeding. Arctic will use reasonable efforts to notify you in the unlikely event of any such subpoena or proceeding. Arctic will take all steps reasonably necessary and possible to ensure the security of your data.

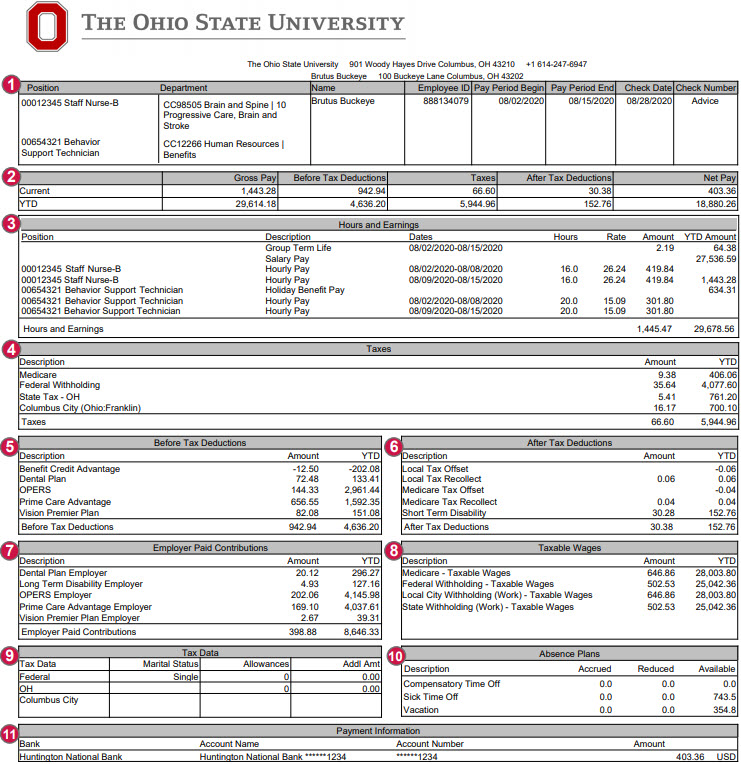

Payslip Overview

Your payslip can be viewed from the Benefits and Pay Hub app in Workday(link is external). All historical paychecks prior to 1/1/21 are also viewable from the Benefits and Pay Hub app by clicking on More Pay Links in the Suggested Links section of the navigation pane.

# | Section | Description |

1 | Employee Information | This section lists your Position, Department, Name, Employee ID#, and Pay Period details. Pay Period Begin and Pay Period End dates list the time period for which you are being paid. Check date is the date of payday. Biweekly pay is issued two weeks after the pay period end date. “Advice” in the Check Number box means your pay has been directly deposited to your bank account on file. |

2 | Pay Summary | This section summarizes the current pay period and year-to-date (YTD) amounts for total Gross Pay, Before Tax Deductions withheld, Taxes withheld, After Tax Deductions withheld, and Net Pay. Net pay is the balance of your pay remaining after taxes and deductions are withheld. It is also referred to as your “take-home” pay. |

3 | Hours and Earnings | The Hours and Earnings section lists your earnings information by type for the current pay period and year-to-date (YTD). Rates and Hours (for biweekly employees) and Amounts are displayed. For biweekly employees, the earnings are further broken down within the pay period by FLSA week. Common earnings types include, but are not limited to:

|

4 | Taxes | The Taxes section is an itemization of the taxes that have been withheld for the current pay period and year-to-date (YTD). These can include Medicare, federal, state, local, and other taxes. Resident state taxes are based on your primary Home Address. |

5 | Before Tax Deductions | Before Tax Deductions are subtracted from your earnings before taxes are calculated. Deductions and amounts are listed for the current pay period and year-to-date (YTD). Examples of before-tax deductions include medical, dental, and vision premiums, retirement contributions for the Alternative Retirement Plan (ARP), Ohio Public Employees Retirement System (OPERS) or State Teachers Retirement System (STRS), before-tax retirement service credit purchases, Flexible Spending Account contributions, and parking fees. |

6 | After Tax Deductions | After Tax Deductions are subtracted from your earnings after before-tax deductions and taxes have been subtracted. Deductions and amounts are listed for the current pay period and year-to-date (YTD). Examples of after-tax deductions include donations to eligible charitable organizations, union dues, Child Support withholding, and retirement service credit purchases. |

7 | Employer Paid Contributions | The Employer Paid Contributions section shows the amount that the university contributes towards the cost of your benefits and other required contributions. Costs are listed for the current pay period and year-to-date (YTD). These are NOT deducted from your earnings. |

8 | Taxable Wages | The Taxable Wages section lists the total amount of wages you received on which you were taxed. Amounts may be different as each withholding type has certain qualifications to determine whether wages are taxable. |

9 | Tax Data | The Tax Data section includes your tax withholding elections for federal and state tax, including your marital tax filing status, the number of allowances you have elected (for 2019 or earlier W-4), and any additional tax amounts you requested to be withheld (for employees hired/rehired after 1/1/20, the default value is Single or Married filing Separately with no adjustments). Your work locality is displayed here as well. |

10 | Absence Plans | The Absence Plans section displays accrued, reduced, and available vacation, sick, and compensatory time off balances as of the end of the pay period that you are eligible for. This does not include requested or approved future-dated absence requests. The Absence Plans section is accurate for all employees, including Health System employees. All employees can see the most current absence balance information in Workday Absence. Note: All employees accrue on a biweekly schedule, not on a monthly basis. Monthly-paid employees see information represented for the biweekly pay period end dates that fall within the month being paid, not based on the work days in the month. |

11 | Payment Information | The Payment Information section displays the accounts you have elected for your direct deposit, including the name of your financial institution, the account name, the last 4 digits of your account number, and the amount deposited into your account(s). |

How do I make a correction to my Name, Social Security Number or Date of Birth?

For a Name change or Date of Birth change, submit a request in HR Connection.

For a Social Security number change, report this number to:

- Glacier: Log in to your Glacier profile and update your number. Print, sign, and send the Glacier forms to the email provided.

- Ohio State Human Resources: Log into your Ohio State Workday account and update your number. Read instructions. If you have any questions, email HRConnection@osu.edu.

Why should donors give now?

There are compelling reasons for contributing to the university, with benefits to acting now:

- Gifts that are invested in the LTIP generate annual support for the university while they continue to grow. This means immediate and long-term support for priorities including scholarships, faculty positions, student programs and capital projects.

- Endowments allow the university to plan based on committed resources. An endowment that funds a faculty chair, for instance, supports that chair and also frees up college resources for other priorities.

- There are advantages to Ohio State’s status as a public institution and institutional investor. Gifts that support Ohio State grow tax-free because the university is a public institution. Our size as an institutional investor provides both economies of scale and investment opportunities that are not available to individual investors.

- Endowments provide consistent, sustainable income that helps offset variations in state funding and other sources.

For information on how to give, go to osu.edu/giving.

What other information do I need to submit my contractor vaccine documentation form?

In addition to providing your name, contact information and your vaccine card OR religious or medical exemption documentation on the contractor vaccine documentation form, you will be asked to identify your medical center contact/supervisor. If you are unsure of who this is, please connect with your vendor employer to confirm.

What if the travel expenses exceed the estimated amounts approved on the Spend Authorization?

Expenses should be submitted as normal on an Expense Report linked to the Spend Authorization. Additional approvals may be prompted when the Expense Report is submitted.

Can I utilize any of the university’s discount programs for personal/leisure travel?

Yes, discount rates are available for personal/leisure vehicle rentals through the university’s agreement. Insurance is NOT included in the rate. The young renter fees for drivers that are between 18-25 is NOT waived. For more detailed information, go to Ohio State Human Resources - Buckeye Nation Reward.

How do I arrange to have a workshop presented in our department or college?

Contact FinancialTraining@osu.edu or (614) 292-8411.

How do I know if the clothing issued is required to be worn?

Your department will be able to inform you if any clothing provided is required to be worn.

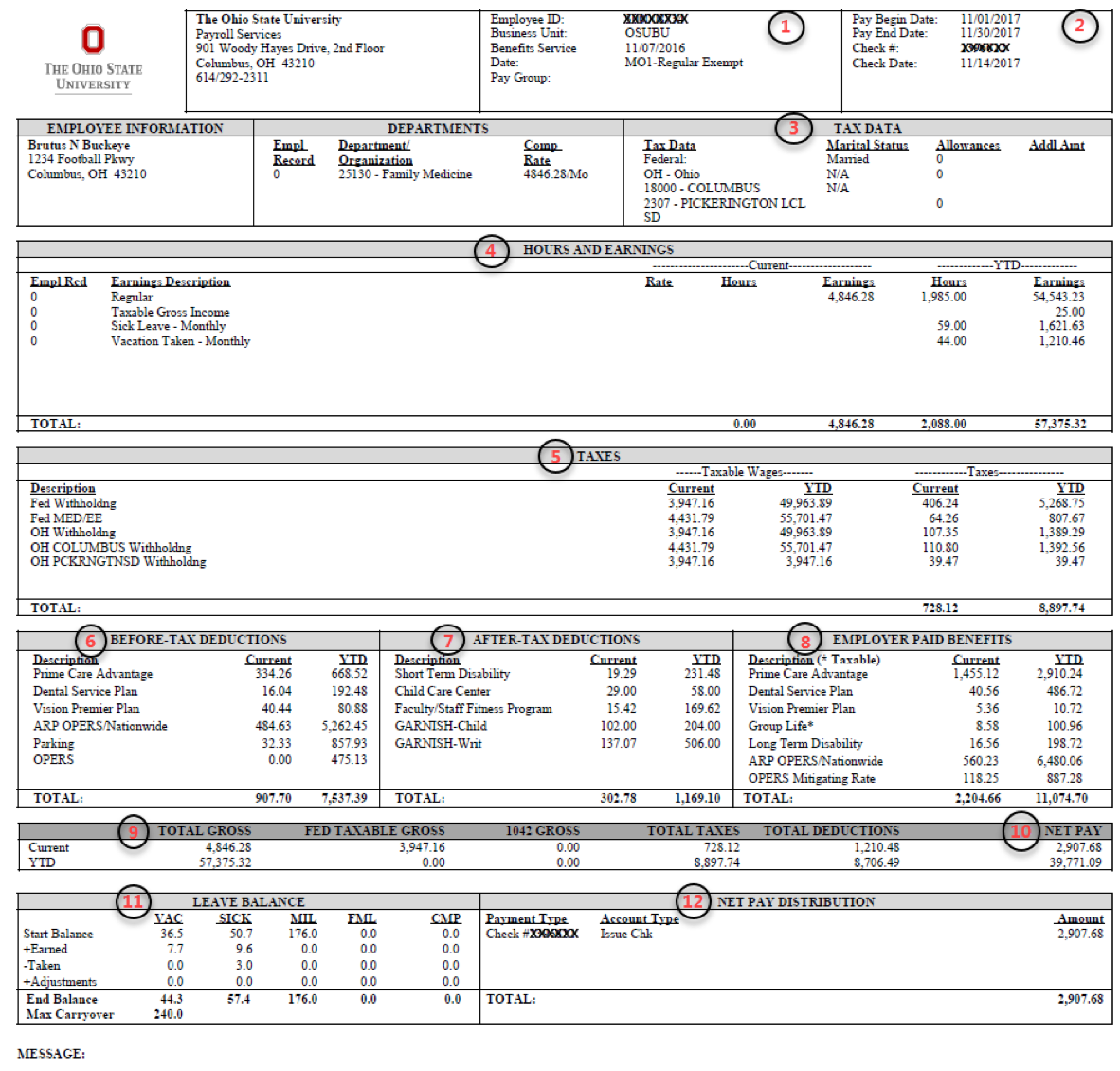

Monthly Payslip Overview

Regular base wages are reported as Salary Pay, Academic Pay, Activity Pay, or Fellowship Stipend depending on job classification.

Most monthly employees will see Holiday Benefit Pay and pay for other types of Time Off listed separate from Salary Pay. However, Paid Time Off earnings do not display on the payslip for “Associated Faculty – Semester”, “Graduate Associate”, and “Other Fellow/Trainee” employees.

All employees who receive Certification Pay will see it displayed separately as its own line item.

If an earning type appears multiple times in the “Hours and Earnings” section, employees will only see the YTD Amount value for that earning type displayed on one line. The amount shown will be the total of all earnings from that earning type.

For One-Time Payments, such as a bonus or other lump sum payment types, employees will see dates in the Hours and Earnings section of their payslip. Although these dates may differ from the Pay Period Begin and End dates, the payment will be paid in full on the payslip check date. The dates that appear in this section of the payslip for One-Time Payments do not have any impact on the payment or the employee. For more information about the One-Time Payment, visit your Worker Profile, click Job, then Worker History. Click View Worker History by Category, and then click on the Compensation tab.

Employees with multiple positions will not see YTD Hour values in the “Hours and Earnings” section of the payslip.

Will GTP file my state tax return?

GTP may only be used to prepare your U.S. federal income tax return. GTP Support cannot assist you with questions regarding the filing of a state tax return. When you have finished your federal tax return, GTP will provide you with a link to your state’s tax website or the blank state tax return form.

What do I do if I have an automobile accident in an university-owned, managed, leased, or rented vehicle?

Call the police and have a report taken at the scene. Obtain the other driver's name, address, phone #, insurance information and the make, model and license # of the other vehicle. At first chance, call Transportation & Traffic Management (TTM) at 614-292-6122 to report the accident.

I'm leaving the country before I can file my taxes. What should I do?

Make sure you have updated your foreign address in Workday so that your Form W-2 and/or Form 1042-S can be mailed to you if you requested this option. W-2 Forms are distributed electronically and Forms 1042-S can be distributed electronically if you opted for this delivery method. Download the appropriate forms and instructions from the IRS website and file your US taxes from abroad. Save copies of all forms submitted for your tax records.

What additional information should I know about the payment of travel expenses for children of employees during a 6-month research trip?

Q: What are the eligibility requirements to pay for travel costs for children?

A: Employees traveling for research for 6 or more months and are accompanied by children are eligible for payment of travel-related expenses for the children.

Q: How is a child defined?

A: The Travel Policy defines a child as a biological, adoptive, step, or foster child; a legal ward; or a child of a person standing in loco parentis, who resides with the traveler.

Q: How is research defined?

A: The Travel Policy defines research as any systematic investigation, including research development, testing, and reporting designated to develop or contribute to the body of knowledge in any field. The term encompasses basic research, applied research, and research training activities in areas such as but not limited to, biomedical and life sciences, natural sciences, engineering, humanities and arts, and social and behavioral sciences.

Q: What are the eligible travel expenses for children of employees during a 6-month research trip?

A: The university will pay for reasonable and necessary expenses incurred for authorized business travel. Eligible expenses for children include airfare, ground transportation (e.g., to/from airport), lodging, per diem, and miscellaneous expenses (e.g., baggage fees, immunizations).

Q: How do I obtain pre-approval for travel expenses for children?

A: Pre-approval is obtained through the Spend Authorization process. Additional approval requirements may exist if using sponsored grant funding.

Q: Do I need to create a separate Spend Authorization for travel costs for children?

A: No, a separate Spend Authorization is not required for the child(ren) of the employee traveler. However, detailed information (e.g., names of participating children, etc.) should be included in the comments of the employee traveler’s approved Spend Authorization. Additional lines for the child(ren)s estimated expenses should be entered.

Q: Can I use university payment tools to cover travel costs for children of employees during a 6-month research trip?

A: Travel expenses for children can be paid with university payment tools with an approved Spend Authorization for the employee traveler. Payment of spouse or partner travel expenses are not permitted and must be paid using personal resources.

Q: Am I still required to book my airfare through the contracted agency if my trip includes travel costs for children?

A: Yes, the employee traveler is still required to book their airfare through the contracted agency.

Q: What if my circumstances don’t fit the eligibility criteria?

A: An exception request must be submitted for review by the Office of Business and Finance and the Office of Academic Affairs. Send requests to Lisa Plaga (plaga.5@osu.edu).

Who created the Supplier/Payee Setup Form and why?

The Supplier/Payee Setup Form was a collaboration between University Purchasing, Accounts Payable, Office of Sponsored Projects Purchasing and Accounts Payable, and The Ohio State University Wexner Medical Center.

The Supplier/Payee Setup Form is primarily used for Misc Payees and Supplier Invoice Requests.

What is the monthly cut-off for interdepartmental billings?

IDB's (both online and interface) may be processed through the end of business on the second working day of the following month.

Are gift cards considered non-cash?

No, gift cards are considered the same as cash and are taxable in any amount.

Form 8843, Statement for Exempt Individuals and Individuals With a Medical Condition

This form is required for a Nonresident Alien who is present in the U.S. under an F, J, M or Q immigration status, regardless of whether or not you have received any income.

My spouse is in the U.S. and doesn't work, why didn't GTP allow me to claim an exemption for him/her?

The eligibility to claim an exemption for a spouse and/or dependents (children) is very limited for Nonresident Aliens. Only individuals from the following countries in limited situations may claim an exemption for a non-working spouse and/or dependents (children): American Samoa, Canada, Mexico, and Students from India (F-1, J-1, M-1 or Q-1 Student immigration statuses only).

Why Is My Tax Status Important?

In order to comply with the U.S. tax laws, your U.S. Tax Residency Status must be determined. The substantial Presence Test is used to determine whether an individual is a Nonresident Alien or a Resident Alien for purposes of U.S. tax withholding. Glacier Online Tax Compliance System will calculate your U.S. Residency Status for Tax Purposes based on the information provided by you.

Where do I mail my tax return?

Form 1040-NR and Form 8843 should be mailed to:

Internal Revenue Service Center

Austin, TX 73301-0215

What does access code mean on the Template Form?

Access codes are required when sending a document that will include restricted data or when sending a document to someone that is external to the university. Please use either the access code or the SMS option. Full details on how to use access codes is available in the following links:

Access Code: https://support.docusign.com/en/guides/ndse-user-guide-access-code

SMS Code: https://support.docusign.com/guides/ndse-user-guide-recipient-authentication

How can I change the bank account where my payment will be deposited?

Submitting changes to your bank account can be done through your Workday worker profile.

How do I update my status to Permanent Resident or Naturalized citizen?

Submit a request through HR Connection and include a copy of your Permanent Resident Card or Naturalization Certificate.

Where do I submit my Time Off requests?

Campus employees submit time off requests in Workday. For more information, please refer to the Time Off Processes job aid on the Administrative Resource Center.

Health System employees submit time off requests in UKG/Kronos. For more information, please refer to the Time Off and Leave Processes (Health System) job aid on the Administrative Resource Center.

I’m an L-1 and that is not a choice for immigration status?

As an L-1, you should select "Other Immigration Status".

Can I reduce the amount coming out of my check each pay?

The amount is set by the court or agency that manages the garnishment. You would need to contact the agency or the creditor’s attorney to discuss arrangements to reduce your payment amount.

What is meant by critical function?

Process or function that cannot be interrupted or unavailable for more than a mandated or predetermined timeframe without significantly jeopardizing the university mission.

How will Authors be approved, is there any specific criteria?

Authors should be aware of the requirements associated with private and restricted data, the delegation authority in their College/VP unit, and the electronic signature policy.

I'm trying to create a Req/PO and the supplier is inactive. The supplier is an ex-employee. What do I need to do?

Please refer to the Supply Chain section in the Administrative Resource Center (ARC) for the related job aids.

Are there additional training opportunities available?

Ohioans have access to free e-learning courses. To access the courses follow these steps:

- Follow Access ohiomeansjobs.com

- Select the “Online Training” picture/link at the bottom of the screen

- Select the Sign In button

- Register as a new user

- Select a user name and password

- Under the All Assessments drop down menu, select “Improve Your Computer Skills”

- On the left hand menu, select the menu option that interests you (uncheck Tests or eBooks if you want eLearning classes)

You can access versions of Microsoft Access, Outlook, PowerPoint, Project, Publisher, SharePoint Designer, Vision, and Word. Class versions for Microsoft 2007-2013 are available.

Remember that:

- Microsoft.com offers many quick tutorials on all of their products

- Members of the Columbus Metropolitan Library have access to Lynda.com. Lynda includes thousands of video based training available at no cost. Access Lynda using your library card number here: https://www.lynda.com/portal/sip?org=columbuslibrary.org.

What do I do if a personal charge was made on my PCard in error?

Personal charges are not permitted on the PCard. However, when an error occurs, the personal amount charged must be repaid to the university within 7 business days. Follow the steps at the Repayment Process for Personal Expense Charged to University Payment Tools - PCard job aid.

What is the difference between buying a bond in the "primary" market versus the "secondary market"?

New bond issues are sold in the primary market. In a new issue, most of the terms are set, including the initial price and interest rate, and the bonds are sold to investors, with the issuer receiving the proceeds of the sale.

A secondary market transaction does not involve the issuer, but is a transaction between two investors - a buyer and a seller. Secondary market transactions involve a brokerage firm which acts either as an intermediary between the buyer and seller, or as a buyer or seller itself. Market conditions, such as prevailing interest rates, supply and demand, and credit quality, among other variables, determine the price, which may differ from the original price.

Are Graduate classes for employees taxable?

Yes. Any graduate tuition assistance fees paid by the university in excess of $5,250 per calendar year is taxable based on your current W-4 exemptions.

State Tax Reciprocity

An employer must withhold Ohio income tax from any wages the employee earns while working in Ohio, even if the employee lives in another state.

State Reciprocity:

Ohio has reciprocity agreements with the five states that border Ohio: Indiana, Kentucky, Michigan, Pennsylvania, and West Virginia

If you are working in Ohio and claiming a permanent resident reciprocity, you can view and change your Ohio tax elections in Workday. If you are a permanent resident of a state that withholds state taxes, you can also view and change your resident state tax elections in Workday.

Refer to the detailed instructions found here, Manage Tax Withholding Elections, on how to update your tax withholdings in Workday.

For further assistance, go to HR Connection.

Can I purchase Basic Economy flights with the contracted travel agency?

Yes. All fares, including basic economy, are eligible for purchase.

When using Concur, a warning is provided to inform you that there are limitations with Basic Economy fares, including that there would be no refund in the event of cancellation. If the fare meets your business need and you are willing to accept the risks, simply acknowledge that you understand the restrictions and continue with the purchase. If you are an arranger and booking on behalf of a traveler, be sure they understand the restrictions that may impact their travel.

Can an employee keep or purchase an asset after its use is complete?

An employee cannot take possession of an asset without documented authorization from the Dean or Vice President of the College/VP area and the Surplus Department.

I am a vendor registered in the Wexner Medical Center’s Vendormate System. What do I need to do?

For any vendor registered in the Wexner Medical Center’s Vendormate system, credentialing should be verified and submitted similar to other criteria (flu, measles, TB, etc.), with a badge printed and worn while in patientcare areas. If not credentialed in the system, badges will not print and access to Wexner Medical Center facilities will be denied.

Can I use my personal credit card to purchase travel-related expenses for another traveler?

It is not recommended to use a personal credit card to pay for travel-related expenses for another traveler. Instead, travelers should use a university payment method (e.g. PCard) if such a need arises.

Contact the Travel Office for further assistance.

Can I upgrade my coach airfare to priority boarding or an upgraded seat?

No. Economy plus, seating upgrades, and/or priority boarding options are not permitted to be purchased with university resources and will not be reimbursed for coach fares.

! Note: When applicable, requests for reasonable accommodations for a disability will be considered by units in consultation with the Americans with Disabilities Act (ADA) coordinator. To determine eligibility, travelers must submit a Reasonable Accommodations Request that identifies the personal need and provide related documentation to support the request (e.g. letter from physician) for expenditures outside of policy. Requests should be submitted prior to the scheduled trip and allow sufficient time to gather required documentation.

For more information, contact the ADA Coordinator’s Office at 614-292-6207. Submit request to: ada-osu@osu.edu

How do I place an invoice on hold or release a hold?

If a department does not want an invoice to be paid, they must notify Accounts Payable via e-mail at apcustomerservice@osu.edu and request that the invoice be placed on hold. When the department approves the invoice, it is their responsibility to notify Accounts Payable (via email) to release and pay an approved invoice formerly on hold in the Financials System.

I’m having technical difficulties accessing the contractor vaccine documentation portal and/or submitting documentation. Who can help me?

You can reach out to acesupport@osumc.edu for assistance with the portal and submitting documentation.

How can the Expense Report be completed if it is stuck pending the approval of a terminated/retired employee traveler?

Expense reports that only contain PCard transactions and are stuck on the last action step in the business process due to the traveler’s inability to approve the expense report (e.g. termination or retirement) will be manually pushed through to an approved status at the close of each fiscal year.

Expense Reports that contain a reimburseable amount that require the employee traveler's certification/approval cannot be accessed by the employee traveler after 60 days from termination/retirement. The outstanding Expense Report must be cancelled. An External Committee Member (ECM) must be generated since employee payment elections are no longer available. A new Expense Report must be created to pay the terminated/retired employee traveler as an ECM .

Are OSU employees eligible for educational or government discount rates for lodging?

When making a hotel reservation, it is worthwhile to inquire about educational, institutional or government rates. As an instrumentality of the State of Ohio, employees of The Ohio State University may be eligible for government rates with business reservations. However, be sure to check with the hotel directly before arrival to determine the discount rate criteria for check-in. In some cases, the OSU BuckID will be accepted in order to receive the government rate, while other hotels may require more specific/official government ID.

How do I apply to be a volunteer for the Financial Training workshops?

We always like to hear from knowledgeable individuals who are willing to assist. Please complete the volunteer agreement form found here. For presenters, we have a multi-step train-the-trainer program to help you get started. We need more than presenters!! We seek volunteers to participate in a focus groups or design sessions.

Who should I ask about the taxability of clothing provided?

Your department will be able to help answer if clothing issued will be treated as a taxable fringe benefit.

Deductions

Deductions taken from your paycheck before taxes include:

Medical, dental, and vision plan premiums you have elected to purchase

Required retirement contributions to the Alternative Retirement Plan (ARP), Ohio Public Employees Retirement System (OPERS), or State Teachers Retirement System (STRS)

Voluntary contributions to 403(b) and 457 Supplemental Retirement Accounts

Voluntary contributions to Flexible Spending Account(s)

Fees for campus parking passes purchased

Other deductions (i.e. pre-tax retirement service credit purchases)

Deductions taken from your paycheck after taxes include:

Union dues

Charitable donations you choose to make through payroll deductions for the Campus Campaign, the Community Charitable Drive or other charity drives

Life insurance you choose to purchase

Other deductions (i.e. after-tax retirement service credit purchases)

Taxes taken from your paycheck as deductions:

Federal

State

Local

School Tax

Medicare

Note: university employees do not pay into Social Security. However, university employees hired on or after 4/1/86 are required to pay the medicare portion of Social Security.

Employees who have completed the Your Plan for Health (YP4H) Personal Health Assessment (PHA) will see a credit for “Benefit Choice” or “Benefit Advantage” on their payslip issued as a negative deduction.

I prefer to call and speak with someone at GTP support, why can't I just call them?

The reasons that we require all support questions to be sent via email are:

- to ensure that we understand your questions - sometimes there are language or accent issues that may make it difficult to understand your questions over the telephone;

- to ensure that you understand our answers - sometimes there are language or accent issues that may make it difficult for you to understand our answers over the telephone, remember that GTP Support Center is in Texas and we like to say "y'all" :);

- to allow you to have the answer in writing so that in the case you forget what we said, you will have an email to review at a later time; and

- to allow us to have a record of the questions that come in so that if we receive the same question several times, we can consider whether we need to make an adjustment in GTP.

If I rent a vehicle while traveling on university business, should I obtain the insurance from the rental agency?

When using the university’s contracted agencies (as required by policy for business travel), the optional Loss/Collision Damage Waiver (also known as DW, CDW and LDW) is already included in the rate agreement for business rentals and should be declined. Accepting the Loss/Collision Damage Waiver Option would simply duplicate the negotiated agreement benefits. The Loss/Collision Damage Waiver is included on business rentals only. See additional FAQs regarding vehicle rental at the University’s Travel Website.

Should I keep copies of my tax returns and other tax forms?

Yes. Always keep copies of your tax return, W-2, 1042-S, 1099 bank interest statements and any other pertinent forms as proof that you have filed. The IRS can audit individual returns for up to 3 years following the filing deadline and your tax records are essential in assisting you in an audit.

When can a blanket Spend Authorization be used?

A blanket Spend Authorization is used to track and reimburse transportation expenses (gasoline, mileage, parking, rental car, tolls), and may be issued once per fiscal year for an individual.

am i awake?

not sure

What is the monthly cut-off for online journal entries?

Online journal entries (excluding IDB's and deposits) may be processed through 7:00 pm on the fifth working day of the following month.

Form 1099-INT, Interest Income

Form 1099-INT is for taxable interest. Sometimes banks issue these forms to nonresident aliens who are not subject to tax on bank interest. The fact that a form was issued incorrectly does not make the interest income taxable.

I have children but GTP did not allow me to claim an exemption for them, why not?

The eligibility to claim an exemption for a spouse and/or dependents (children) is very limited for Nonresident Aliens. Only individuals from the following countries in limited situations may claim an exemption for a non-working spouse and/or dependents (children): American Samoa, Canada, Mexico, and Students from India (F-1, J-1, M-1 or Q-1 Student immigration statuses only).

What is a Tax Return or Tax Filing? Why Do I Need to File?

Any of your earnings in the United States are subject to applicable federal, state, and local taxes. Filing tax paperwork, such as a tax return, is a reconciliation that compares what you actually paid in taxes throughout the year to what you should have paid in taxes.

Employers and schools are required by law to withhold taxes from your paychecks or taxable stipend payments. If the taxes that were withheld from your payment are higher than what you should have paid, you will get a refund after filing your tax return ("tax refund"). If taxes were not withheld, or insufficient tax was withheld, then you will owe money at the time of filing your taxes. You declare your income and account for the taxes owed on a form or set of forms called a “tax return.”

Form 1042-S, Foreign Person's U.S. Source Income Subject to Withholding

Form 1042-S is an income reporting form which is required to be issued by employers and payers to report your income and taxes withheld if any, to you and the Internal Revenue Service (IRS). The IRS uses this information to compare against your tax return to assure that you are reporting your income on your return.

This year-end tax document is provided to a nonresident alien who received wages covered under a tax treaty or received fellowship payments.

Treaty exempt wages are reported on this form with Exemption Code 04. The Income Code (IC) indicates the type of income reported on the form such as 16 (Scholarship or Fellowship), 17 (Independent Personal Services), 18 (Dependent Personal Services), 19 (compensation of a teacher or researcher), 20 (compensation during studying or training), 54 (Other Income).

Ohio State is required to furnish your yearly 1042-S by March 15 of the following year. You may elect to receive your 1042-S online through Glacier. Otherwise, you will receive a copy of your Form 1042-S by U.S. Mail.

In certain cases, you may receive multiple 1042-S forms with different income codes.

Some nonresident aliens may receive a W-2 in addition to a 1042-S. If you consented for online delivery of your W-2, you can access it via Workday.

How do we make a template ADA Compliant?

Instructions can be found in the Author Training: eSignature Author

Who should I contact with a question concerning where my payment was deposited?

Contact the Accounts Payable office at 614-292-6831 or send an email to apcustomerservice@osu.edu.

How do I update my visa/immigration information?

Update your information through the Glacier website and submit a request through HR Connection with a copy of your updated paperwork.

I am a salaried (exempt) employee. How is the hourly rate calculated for the time off on my payslip?

Paid and unpaid time off will both be calculated based on working hours in a given month (this can result in different rates for different months.) For an exempt employee, the hourly rate calculation is based on FTE and the number of weekdays in the month when the time off was taken.

The total paid time off amount calculated offsets salary pay.

The total paid time off amount calculated offsets salary pay.

The total unpaid time off amount is reduced from salary pay.

Will GTP file my state tax return?

GTP is only be used to prepare your U.S. federal income tax return. GTP Support cannot assist you with questions regarding the filing of a state tax return. When you have finished your federal tax return, GTP will provide you with a link to your state’s tax website or the blank state tax return form.

How much will be deducted from my check because of the garnishment?

- Child support: The amount is set by the child support agency

- Bankruptcy: The amount is set by the court and approved by the employee

- Student Loan repayment: 15% of your disposable earnings (gross wages minus all taxes)

- Writ of Garnishment: 25% of your disposable earnings (gross wages minus all taxes)

What is a Recovery Time Objective (RTO)?

The Recovery Time Objective (RTO) is the period of time following an incident or disruption within which a critical function and/or process and application and/or system must be resumed, recovered or restored to avoid unacceptable risks or consequences.

Will all University Forms be available in eSignature?

The form owners will assess whether eSignature is the appropriate place for the documents to be housed. The timeline will be determined by the form owner.

I have indicated "Hold for Pick-up" on the reimbursement request in the Travel system. How will this impact the employee who has direct deposit?

The "Hold for Pick-up" designation will not be effective for employees who have direct deposit. The same is true for the "Mail" designation.

What is the vendor COVID-19 Vaccine Requirement?

All vendors that have been identified as embedded within our university, as defined below, are expected to have their employees fully vaccinated against COVID-19 or meet exemption criteria by Dec. 8, or test weekly.

What expense item type should I use to expense an erroneous personal charge?

You should use the expense item type that maps best to the item purchased when expensing the transaction.

What are some risks involved in investing in municipal securities?

Credit Risk - Risk that the issuer is not able to pay the scheduled principal and interest on a full and timely basis. A change in the credit rating on bonds after they are issued can affect their value.

Interest Rate Risk - Interest rate risk is the risk that changes in market interest rates may increase or decrease the market value of a bond. When interest rates decrease, the price of fixed-rate bonds and notes increases, and when interest rates increase, the price of fixed-rate bonds and notes decreases.

For a more thorough discussion of the risks associated with a particular municipal security, potential investors should read the associated official statement and consult a licensed financial professional.

What if I want to sell my municipal security prior to maturity?

Municipal securities may be sold prior to maturity with the assistance of a brokerage firm. If an investor sells a municipal security prior to maturity, he or she may receive more or less than the original price depending on prevailing market interest rates, supply and demand, and perceived credit quality of the bond or note, among other variables. In addition, the investor should consult a tax advisor for any tax implications.

Can I still get paid without having direct deposit set up?

Yes. if you don’t have direct deposit set up, Payroll will issue you a pay card that will be mailed to the home address you have in Workday.

Fellowship Tax Information

IRS site provides detailed estimated tax information regarding Fellowships. Please utilize this resource for your Fellowship inquiries.

Why should I sign up for a pay card?

Direct deposit has advantages over paper checks for a variety of reasons, including greater security, speed and simplicity. Starting July 1, 2019, Ohio State will pay all employees through a direct deposit option - either a checking account, savings account or pay card. (Paper checks will no longer be an option.)

You can choose the direct deposit option that works best for your situation, including splitting your pay into several accounts. A pay card is simply one of the options for direct deposit.

Wisely Pay card publishes a webpage that provides some details about its pay card system.

Can I take an asset off campus?

Authorization to take an asset off campus is at the discretion of the unit’s Asset Coordinator and Dean/VP/SFO/Designee and must be documented on the AM-Asset Off-Camus Stewardship Form.

What if a vendor does not submit the online attestation form by the deadline?

Progressive actions that may include:

- Limitations or restricted presence on Ohio State’s campus

- Removal of access to facilities and systems

- Further action up to and including contract termination

Can I split travel-related expenses between two different people on my personal credit card?

It is not recommended to use a personal credit card to pay for travel-related expenses for another traveler. Instead, travelers should use a university payment method (e.g. PCard) if such a need arises.

Contact the Travel Office for further assistance.

Can I purchase an upgraded seat instead of the business class airfare permitted with an international flight that meets the five consecutive flight hours criteria?

Business class airfare purchases are only permissible with international flight times in excess of five consecutive hours (excluding layovers), however a lower priced economy seat with a seating upgrade may be purchased in lieu of the business class flight as long as the cost does not exceed the business class option quoted at the original purchase.

!Note: An upgraded economy seat instead of a business class seat may be considered an adequate option for an International flight that is more than five consecutive hours. In many cases, the cost of the upgraded economy fare is less expensive than the business class fare that is eligible with an international flight of more than five hours. Comparison quotes should be collected at time of original booking to ensure the upgraded economy fare is less than the most reasonable business class option that meets the business needs of the traveler. A screenshot image of the comparison fares and relevant details should be taken to properly justify the selection.

How do I set up and replenish petty cash funds?

Petty cash funds are established and approved by the Treasurer's Office. When the Treasurer's staff has reviewed and approved the request, the departments submit a payment request, and a check is generated to start the petty cash fund.

To replenish the fund, the department submits a payment request via PREP. Departments are responsible to retain receipts, and ensure necessary approvals and controls.

I work in a Wexner Medical Center building that is under construction. Do I need to comply?

If you work as a vendor in a Wexner Medical Center building that is under construction and not occupied by patients, you do not need to comply with the COVID-19 vaccine requirement.

Do I need to separate the fees and taxes from the nightly lodging rate on an Expense Report?

It is recommended to enter the total lodging expense (including fees and taxes) under the Lodging expense item type.

Who are the University’s Contracted Travel Agencies?

Contracted Travel Agencies are offered to the university community to serve specific travel demographics.

- For Individual Business Travel: Corporate Travel Planners (CTP)

- For Group Business Travel (10+ passengers): ScholarTrip

- For Athletic Team or Athletic Individual travel: Anthony Travel

How do I register for a Financial Training workshop?

Financial Training uses a self registration method; use the BuckeyeLearn website to register for any instructor-led workshop.

What if I receive a clothing allowance through my paycheck and am not issued the clothing directly?

Clothing allowances are always taxable when paid through your payroll check. There is no exemption even if the money is spent on items that meet the excludable requirements.

Deductions - COTA

Employee COTA Bus Access Election Instructions:

Log in to Workday

Select the Benefits and Pay Hub app.

Click on Pay, then select Voluntary Deductions.

Select COTA Bus Access as the Deduction, click Add

Frequency: defaults to Ongoing

Pay Cycle Frequency: defaults to the employee’s pay frequency (Monthly or Biweekly). For Biweekly, the deduction is only withheld on the 2nd payday of the month.

Start Date: Enter the date for the deduction to begin. NOTE: The deduction withheld provides the employee with a bus pass for the following month. For example, a deduction is withheld on a March check date will provide the rider with a bus pass for the month of April.

End Date: This is not a required field; however, the deduction will continue until the employee enters an End Date. NOTE: Once the deduction stops being withheld, your access to ride the bus will stop at the end of the following month. For example, your last deduction was withheld in June, and there was no deduction in July, your access to ride the bus will stop July 31.

Next Payment Date: This field automatically populates

Type: Defaults to Amount

Value: Defaults to the current amount of $58

Where can I get more information or assistance?

If you have questions or need assistance, please click on "Help" at the top right of any screen in GTP. If you have additional questions, you may send an email to support@glaciertax.com. In your email, please be as specific as possible. Please DO NOT include your social security number or ITIN in the email as we do not need that information to assist you. ALL support questions are handled by GTP Support via email; no phone calls will be accepted.

When a third party is using Ohio State's property, what insurance is required?

Liability insurance would respond to the damaged caused by the renter or user of our space. The user of our space would find coverage either through an existing policy, this could be through their company liability policy, a related national association, an endorsement to a homeowners policy or purchase of a short term policy such as Tenant User Liability Policy (TULIP).

I’m unable to file by the deadline, what do I do?

File Form 4868, “Extension of Time to File” which extends the deadline to file until August 15. If you owe any taxes though, you must still mail your estimated tax payment by April 15 or you will be assessed penalty and interest charges as of April 15 on any payment owed.

Is a Spend Authorization used for relocation expenses?

No. Relocation expenses are not considered business travel and should not be submitted on a Spend Authorization. Contact Relocation Services (relocation@osu.edu) for further guidance.

Who are you?

I don't know. Still figuring that out.

How do I post an entry to the prior month before the monthly cut-off?

Override the system default date by entering a date in the prior month or by clicking on the calendar icon and choosing the appropriate date of the prior month. This may be done only while the prior month is still open (i.e., before the appropriate cut-offs during the following month).

What type of non-cash items are required to be reported?

All non-cash employee prizes, gifts, tickets to events, any clothing that was not approved for exemption, etc.

Why do I need a social security number?

A nonresident alien must obtain a social security number only if he / she is engaged in a trade or business in the U.S. and will be required to file a U.S. tax return. A social security number is also needed to invoke your tax treaty.

Should I make a copy of my tax return?

Always make a copy of any correspondence you send or forms/returns you submit to the IRS or any other U.S. governmental agency, especially an income tax return. You MUST keep the copy of your tax return and all attached forms for THREE CALENDAR YEARS AFTER YOU FILE YOUR TAX RETURN. You should take the copies of your tax returns with you when you leave the U.S. If you return to the U.S. for a future visit, when you apply for a future visa to the U.S., you may be asked to show that you complied with all U.S. tax laws.

Form W-2, Wage and Tax Statement

This is an income reporting form which is required to be issued by employers and payers to report your income and taxes withheld if any, to you and the Internal Revenue Service (IRS). The IRS uses this information to compare against your tax return to assure that you are reporting your income on your return.

Form W-2 is used to report taxable wages and taxes withheld of U.S. citizens, resident aliens, and nonresident aliens. It also includes Medicare wages and taxes which are used by the Social Security Administration for determining future Medicare benefits.

The W-2 is made available by January 31 of each year. It is necessary to opt in via Workday to receive this form electronically.

What are Income Codes?

The income code defines the type of income.

- 16 Scholarship or Fellowship

- 17 Independent Personal Services

- 18 Dependent Personal Services (generally limited to individuals from Canada)

- 19 Teaching or Research

- 20 Studying and Training

- 42 Payments to Performers/Artists

- 43 Payments to Performers/Artists (signed Central Withholding Agreement required)

- 54 Other Income

What happens if we were unable to complete the Template Review by 9/1?

Any templates that you are unable to review prior to 9/1 will be available in the Demo environment: Demo.Docusign.com, for a period of time, until the Template review is completed. Simply log into the Demo instance and complete the template review and then the template will become available again

If my pay is deposited into multiple accounts, will my payment be deposited the same way?

The Accounts Payable system provides for only one bank account so each employee payment will be deposited into a single bank account. If you have multiple direct deposit accounts for your pay, your payment will be deposited in the account you have designated as receiving your remaining balance, also referred to as your "balance account".

Where do I approve my employee's time or hours worked in Workday?

Hours worked can be approved from your Workday inbox or Time and Absence Dashboard.

For more information, please refer to the Time Tracking for Managers job aid on the Administrative Resource Center.

What should I do if I did not receive all the forms that should have been sent to me?

DO NOT COMPLETE GTP UNTIL YOU HAVE RECEIVED ALL OF YOUR FORMS. If you believe that you should have received a Form W-2 or Form 1042-S and you have not yet received such form, do not contact GTP Support, you must contact the institution that made payments to you and request the form. Generally, Forms W-2 are issued by the Payroll Department; generally Forms 1042-S are issued by the Tax or Payroll Department. If the form was sent to the wrong address, the institution will provide you with a new copy of the form. You should NOT complete GTP until you have ALL of your forms; doing so, may mean that you will file an incomplete and incorrect tax return.

Submit a ticket through HR Connection if you have not received your forms from Ohio State.

Will you garnish my wages every paycheck?

Yes. Each pay will be garnished until we receive a "Release Form" from the court.

When is the Recovery Time Objective (RTO) set?

The business function RTO is initially set during the BIA process. The IT system application and system RTO is initially set during the Systems Development Lifecycle prior to production release.

What is a tag?

DocuSign tags are used to indicate locations on a document where the recipient needs to take an action and to provide information for the recipient. Some examples include: Signature, Date Signed, Radio Button and Check Box.

More information can be found: https://support.docusign.com/guides/ndse-user-guide-field-types

I have employees who regularly travel and receive a cash advance. Is this issued as a paper check or direct deposit?

If the employee has direct deposit of their pay, then the cash advance will also be issued as a direct deposit. Employees who receive a paper check for pay purposes will also receive a paper check for reimbursements, including any cash advance.

Who is considered a vendor?

The term “vendor” includes vendors, sales representatives, consultants, contractors, subcontractors, subconsultants and any other such service providers as the university designates. The university retains sole discretion to determine whether a vendor is covered by the requirement.

Government auditors and inspectors are not considered vendors and are not covered by this requirement.

Can I split a transaction if it is above my single transaction limit?

Purchases must not be split to avoid the established single transaction limit. If the purchase is higher than the standard limit, a PCard Maintenace Form should be submitted to request a temporary limit increase.

What are variable rate demand obligations?