About the Office

The Office of Investments was established to ensure strategic management of the university's Long-Term Investment Pool (LTIP), which encompasses thousands of endowment funds that support access, affordability and excellence.

Led by Vice President and Chief Investment Officer, Vishnu Srinivasan, the university's investment team employs a strategy that is designed to deliver long-term returns for the Ohio State community. Generating strong real returns over market cycles and active risk management are both critical parts of our investment process.

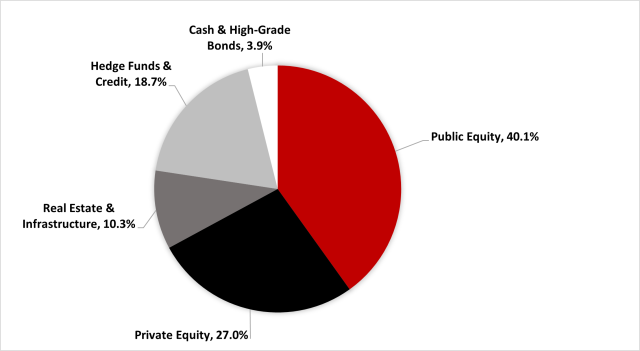

The Office of Investments utilizes a diversified asset allocation model that groups assets into five broad categories: Public Equity, Private Equity, Real Estate & Infrastructure, Hedge Funds (including Liquid & Illiquid Credit), and Cash & High-Grade Bonds. We partner with external managers and their specialized investment teams from around the world to implement our strategy. This model allows the Office of Investments to be responsive to changing market conditions.

Contacts

Investment managers:

(614) 292-7887

Prospects-Illiquids@osu.edu

Prospects-Liquids@osu.edu

Questions about giving:

The Ohio State University Foundation

(614) 292-2970

giveto.osu.edu

Public or media questions:

busfin@osu.edu

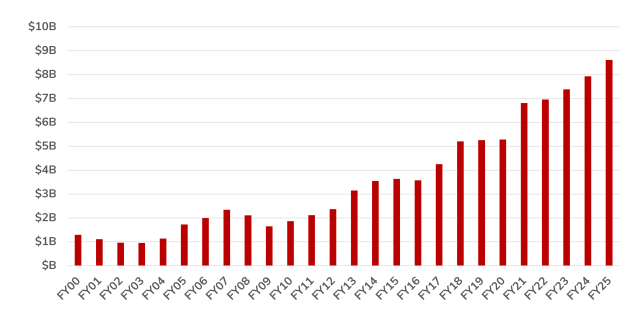

LTIP Size

Long-Term Investment Pool - Portfolio Snapshot

Investment Performance

| 1 Year | 3 Year | 5 Year | |

|---|---|---|---|

| Total LTIP | 11.81% | 9.79% | 11.55% |

| Policy Benchmark* | 9.54% | 9.65% | 9.32% |

*Policy Benchmark based on preliminary data until final benchmark returns are published approximately four months after the end of the fiscal year.

Asset Allocation as of June 30, 2025

Long Term Asset Class Targets and Ranges

| Asset Class | Long-Term Target | Long-Term Range |

|---|---|---|

| Public Equity | 35.0% | 30% - 55% |

| Private Equity | 30.0% | 15% - 40% |

| Real Estate & Infrastructure | 10.0% | 5% - 15% |

| Total Equity | 75.0% | 60% - 90% |

| Hedge Funds & Credit | 12.5% | 0% - 25% |

| Cash & High-Grade Bonds | 12.5% | 0% - 25% |

| Total Diversifying Assets | 25.0% | 15% - 35% |

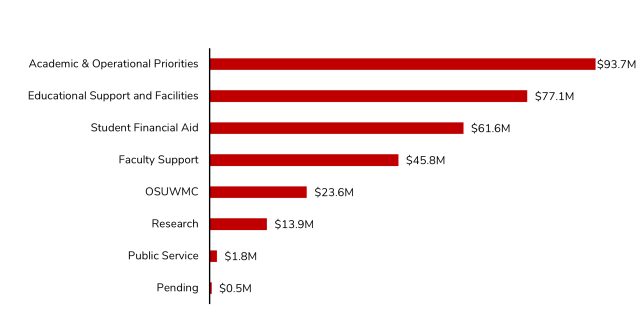

What the Portfolio Supports

The Long-Term Investment Pool contains thousands of endowments funded by private gifts, strategic investments by the university.

Endowments generate more than $60 million annually for student scholarships and cover the cost of other priorities that might otherwise be borne by tuition and tax dollars. Students benefit from access to these resources, which improve the quality of education and healthcare at Ohio State.

FY25 Distributions: $318 Million

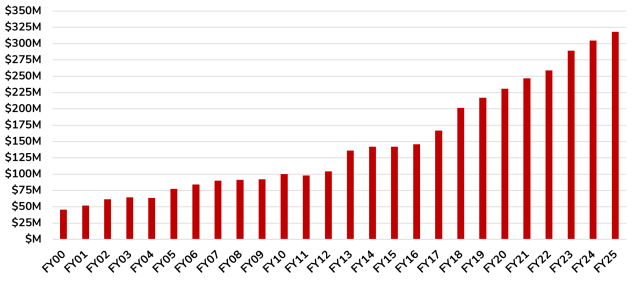

Historical Distributions

The Office of Investments supports Ohio State's mission as a leading flagship national research university through its management of the Long-Term Investment Pool. Our investment strategy is designed to deliver long-term, risk-adjusted returns to grow and protect the value of thousands of endowment funds that support access, affordability, and excellence.

For information about short- and intermediate-term investments, see the Treasurer's Office website.