Pay Online

Paying online is the fastest and safest way to post payment to your account. When you pay online, via electronic check payment, credit or debit card, the transaction posts immediately to your statement of account, clearing the balance due by the amount you paid. You may choose from one of the following payment methods:

- Electronic Check Payment (ACH) - use your bank account and routing number for funds withdrawal from your account; there are no fees associated. Select "New Bank Account" when making your payment.

- Credit or Debit Card - use your MasterCard, Visa, Discover, or American Express debit or credit card number for payment processing. All credit and debit cards must be payable in US dollars. Select "New Credit or Debit Card" when making your payment. Note: A non-refundable convenience fee is assessed by our payment processor for debit and credit card transactions. Please be mindful of your payment choice.

- Foreign Currency Wire Transfer - initiate a wire transfer from a non-US bank to Ohio State using Convera (previously Western Union) currency conversion. Select "Foreign Currency" when making your payment.

Pay Online in My Buckeye Link (Current Students)

Pay Online as Authorized Payer (Non-Student Payers)

Account Set-Up By Student Required

Important: these online web payment portals are intended for current term tuition and fees. If you need to pay past due tuition and fees from a prior term, please visit the Collections page on this site.

Resources:

Other Payment Options

Please consider paying online when feasible, as it is fast, convenient, and safe. If you are unable to remit payment this way, you may utilize one of the following options. For our safety and your peace of mind, we cannot accept cash payments, either in person or by mail.

Mail a Payment - Personal Check

Please make all checks payable to The Ohio State University and include the student's name and OSU ID number in the Memo line. Failure to include this information with your payment may result in processing delays.

Submit your personal check payment to:

The Ohio State University

PO Box 183248

Columbus, OH 43218-3248

Payments must be postmarked by the fee payment deadline in order to avoid late fees. Please allow 1-2 weeks from the time you send your payment for it to post to your account. All mailed payments are processed within 2-3 business days of receipt at the Office of the University Bursar.

Resources:

Electronic Delivery or Mail a Payment - 529 College Savings Plan

We recommend contacting your College Savings Plan administrator to begin the withdrawal process at least 4 to 6 weeks prior to the fee payment deadline to ensure that funds are received by the fee payment deadline. As proof of enrollment for the term, you may submit to your plan administrator a copy of your statement of account.

College Savings account payments should be made out to The Ohio State University. Each item sent should include the student's name and OSU ID number. Failure to include this information with your payment may result in processing delays.

Check with your 529 plan provider for electronic delivery options. Otherwise, you may request that your mailed 529 payment be sent to:

The Ohio State University - 529 Plan

PO Box 183248

Columbus, OH 43218-3248

For 529 payments sent via FedEx, UPS or other courier that requires a physical mailing address (non-PO Box), please use:

The Ohio State University - 529 Plan

2nd Floor, Student Academic Services Building

281 W. Lane Avenue

Columbus, OH 43210

Payments must be postmarked by the fee payment deadline in order to avoid late fees. 529 payments are not necessarily mailed the day you request the funds, as companies require processing time prior to mailing. We recommend initiating your 529 withdrawal 4-6 weeks prior to the fee payment deadline. All mailed payments are processed within 2-3 business days of receipt at the Office of the University Bursar.

Note: if a refund is generated from excess 529 funds, it will be issued to the student.

Pay In Person

To submit a check in person, please visit the secure payment drop box on the first floor of the Student Academic Services Building (across from the elevators). Your check should be made payable to The Ohio State University and include the student's name and OSU ID number in the memo line. Failure to include this information with your payment may result in processing delays.

The payment dropbox is regularly checked by a member of the Office of the University Bursar payment processing team.

Other Wire Transfer Options

If you are unable to make a foreign currency wire transfer through our online web payment portal, please contact the Office of the University Bursar at bursar@osu.edu to explore alternate arrangements.

Pay in Installments - Tuition Option Payment Plan

Ohio State's Tuition Option Payment Plan (TOPP) allows you to divide the cost of tuition, fees, and housing (if you live on campus) into installment payments. The deadline to enroll in TOPP is by the second installment due date of a term.

Resources:

TOPP Enrollment Details

TOPP enrollment is optional. To participate, you must sign up each semester through your My Buckeye Link account. A $30 non-refundable enrollment fee is assessed each term you enroll and due with the first payment plan installment.

When you enroll in TOPP, you automatically authorize any federal financial aid on your account to pay non-institutional charges that you may have incurred which are TOPP eligible (for example, Student Health Insurance).

For assistance with TOPP, please contact Buckeye Link.

TOPP Installment Due Date Schedule

The first TOPP installment and $30 enrollment fee are due at the semester fee payment deadline. Subsequent installments are due approximately every 30 days after the first installment. Installment due dates may fluctuate based on semester start dates. Please refer to your statement of account for exact due dates.

Sample TOPP Payment Installment Due Date Schedule:

| Semester | 1st Install & Enrollment Fee | 2nd Install | 3rd Install | 4th Install |

|---|---|---|---|---|

| Autumn | August | September | October | November |

| Spring | December or January | February | March | March or April |

| Summer | April or May | June | July | - |

Pay TOPP Installments

To make a payment toward a TOPP installment, choose from one of the payment methods outlined on this page.

If you pay online, you must manually initiate a TOPP installment payment ahead of each due date; automatic account withdrawals are not available. We recommend setting a recurring calendar reminder to help you remember to make your monthly payment installment prior to the due date.

Charges Ineligible to Enroll in TOPP

Most charges assessed to your student account are eligible to enroll in TOPP. The following charges CANNOT be enrolled in TOPP.

- Late Payment Fees (including those assessed by University Housing and Dining)

- Late Registration Fees

- Collection Charges

- Returned and Rejected Payments

- Prior Term Charges

- BuckID Charges

- John Glenn Washington Intern Housing (aka WISH Housing)

These charges are due as noted on your student account.

Changes to TOPP Installment Amounts

Changes made to your account after a TOPP installment due date will adjust your remaining TOPP installment amounts equally. Changes can include, but are not limited to adding or dropping courses; financial aid adjustments; and housing and/or meal plan changes.

TOPP Late Fees and Non-Payment

Failure to pay by the due date listed for each installment may result in late fees being assessed to your account:

- Up to $300 for the first installment

- $25 per installment for subsequent installments

Additionally, nonpayment of TOPP installments may result in the addition of a financial hold and/or finance charges to your account, the dropping of future registration, and other consequences as outlined in the Financial Responsibility Statement.

Protect Your Investment - Tuition Insurance

Ohio State offers students the opportunity to purchase tuition insurance through GradGuard, which can help students and families overcome the financial loss of an unexpected withdrawal. Plans can provide reimbursement for tuition payments, room and board, and other nonrefundable academic fees if a student withdraws due to a covered illness, injury, mental health condition, and more.

This insurance is entirely optional and is available as a resource for families seeking additional financial protection beyond Ohio State’s existing refund policy. Any agreement entered into is between the student and GradGuard.

Please note: The Ohio State University does not endorse GradGuard or receive compensation from its promotion. Students and families are encouraged to carefully review the terms and conditions of any insurance policy before enrolling.

Resources:

Payment Processing Timelines

To avoid having a late fee assessed to your account, please submit your payment in a timely fashion. The following payment processing timelines are intended as a guide to ensure your payment arrives on time. Note that mailed timelines may increase at peak periods in mid-August, late December, early January, late April, and early May. During these periods, allot extra time.

Electronic Payments - ACH and Credit Card

Electronic payments post to your statement of account immediately upon transaction completion. This is the preferred method for making payment.

Mailed Personal Payments

Mailed personal payments are processed within 2-3 business days of receipt by the Office of the University Bursar. Please allow 1-2 weeks from the time you send your payment for it to arrive at our office. Your payment must be postmarked by the fee payment deadline in order to avoid late fees.

529 College Savings Plan Payments

529 College Savings Plan payments require processing time with your plan provider and are not necessarily issued to Ohio State the day you request the funds. We recommend initiating a withdrawal from your 529 account as soon as bills are available approximately 4-6 weeks before the fee payment deadline. 529 payments are processed within 2-3 business days of receipt by the Office of the University Bursar.

Foreign Currency Wire Transfer Payments

Foreign currency wire transfers must be fully complete before they will post to your student account. Typically the process takes 5-10 business days from the time you initiate the payment with your home (foreign) bank.

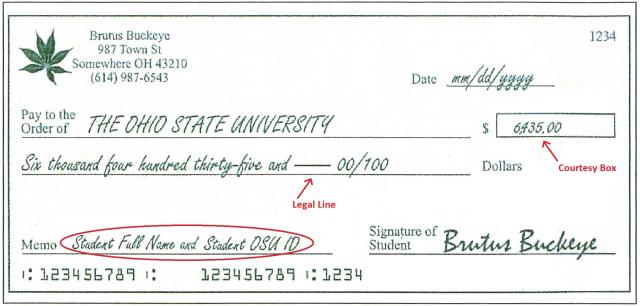

How to Complete a Paper Check

Paper checks must be correctly completed in order to be accepted. Please carefully review your check for errors prior to submitting it using one of the payment options outlined in the section above.

How To Complete a Paper Check

- Date: the date the check is written in MM/DD/YYYY format.

- Pay to the Order of : The Ohio State University (Ohio State or OSU are also acceptable)

- Courtesy Box: amount you are paying in numbers. This must match the legal line; if it does not, the amount spelled out on the Legal Line will be recorded to your account.

- Legal Line: amount you are paying in words. This must match the Courtesy Box; if it does not, this is the amount that will be recorded to your account.

- Memo: enter your full name and OSU ID number here.

- Signature: signature of the person who authorizes the withdrawal of funds. This should match the contact information in the top left corner of the check.

Payment Acceptance Policies

The following payment acceptance policies ensure that Ohio State adheres to highest standards of fiscal stewardship while mitigating risk to the institution and to you.

Acceptable Checks with Proper Identification

The following are considered acceptable checks with proper identification:

- Cashier’s Check – a check purchased at a bank for any amount; the bank completes all information on the face of the check with a bank officer signing as the maker.

- Certified Check – a personal check guaranteed by the bank; the check is stamped “certified” and signed by a bank officer.

- Money Order – an item purchased at a bank, post office, or other business establishment. The bank completes only the amount information.

- Traveler’s Check – a special check supplied by banks or other companies for the use of travelers; these checks already bear the purchaser’s signature and must be countersigned in the cashier’s presence.

- Personal Check – a written order payable on demand, drawn on a bank by a depositor; a personal check is written against an individual’s funds as opposed to a cashier’s check, certified check, money order, or traveler’s check, all of which are written against bank funds. Personal checks are accepted for purchase of good or services. Cashing of personal checks is prohibited.

- Starter Check - a generic check obtained at the bank that is generally provided prior to receipt of personal checks containing printed identifying information. Individuals may have to fill in the areas normally printed on a personal check with their personal address, phone number, driver's license number and other identifiers. Starter checks are not acceptable when exchanged for goods and services whose total value is greater than $500.

Unacceptable Checks

The following payment types are not accepted by The Ohio State University.

- Counter Check – a non-personalized, non-encoded check that is available at most banks.

- Third Party Check – a check made payable to a person or organization other than the one accepting or cashing the check (for example, a paycheck).

- Foreign Check (unless there are exceptional circumstances) – a check written on a foreign bank (e.g., a Canadian bank) not specifically prepared as U.S. currency.

Returned Checks and Rejected Web Payments

If you submit a paper check or electronic payment and it is returned from the bank, your balance will become immediately due. Additionally, your account may be subject to a $30 returned check charge. You will be notified via email if your payment has been returned. Reasons a payment could be returned include:

- Account closed

- Account cannot be located

- Insufficient funds in the account

- Stop payment

Additional reasons a paper check payment could be returned include:

- No signature

- Unauthorized signature

- Check incorrectly written

You are encouraged to submit a replacement payment as soon as possible after you are notified of the return to avoid collections activity on your account. When you submit your new payment, please also include $30 for the returned check charge in addition to the original amount.

If you made your payment online and it was rejected for insufficient funds in the account, your ability to pay online in the future may be restricted. Please contact Buckeye Link for additional information.

Multiple instances of payments being returned from any bank may result in a hold being added to your student account. Your payment options may also be limited, requiring you to pay your bill using only certified funds (i.e., cashier’s check or money order). If the situation requires it, further disciplinary action may also be taken.

Related Resources

- Registration, Fees and Important Dates

- Buckeye Link

- Student Financial Aid

- My Buckeye Link Reference Guide

- Ohio Residency for Tuition

- University Housing

- Dining Services

- Student Health Insurance

- Student Legal Services

- The Graduate School

- Military and Veterans Services

- Office of International Affairs

- Admissions

- Office of Human Resources

Contact Buckeye Link

P: 614-292-0300

W: help.osu.edu

Location

1st Floor Lobby

Student Academic Services Building

281 W. Lane Avenue

Columbus, Ohio 43210

Office Hours

M-R 9:00am - 5:00pm

F 9:00am - 4:00pm