Absence | Change of Record | Clothing | Compensatory Time Off Aged Payouts | Deduction | Direct Deposit | Employee & Dependent Education Assistance | Federal Tax on Tips and Overtime | Garnishment | Non-Cash Items | Pay Card | Social Security Number | Time Tracking | Work State and Work Local Taxation | Nonresident and Resident Aliens | Sprintax

I am a salaried (exempt) employee. How is the hourly rate calculated for the time off on my payslip?

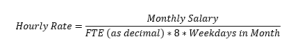

Paid and unpaid time off will both be calculated based on working hours in a given month (this can result in different rates for different months.) For an exempt employee, the hourly rate calculation is based on FTE and the number of weekdays in the month when the time off was taken.

The total unpaid time off amount is reduced from salary pay.

Where do I submit my Time Off requests?

Campus employees submit time off requests in Workday. For more information, please refer to the Time Off Processes job aid on the Administrative Resource Center.

Health System employees submit time off requests in UKG/Kronos. For more information, please refer to the Time Off and Leave Processes (Health System) job aid on the Administrative Resource Center.

How do I make a correction to my Name, Social Security Number or Date of Birth?

For a Name change or Date of Birth change, submit a request in HR Connection.

For a Social Security number change, report this number to:

- Sprintax: Log in to your Sprintax profile and update your number.

- Ohio State Human Resources: Log into your Ohio State Workday account and update your number. Read instructions. If you have any questions, email HRConnection@osu.edu.

Who is responsible for submitting a Determination of Taxability Form and where can I find the form?

A Determination of Taxability Form should be submitted by the unit providing the article of clothing. Each unit will be responsible for identifying and designating the individuals responsible for submitting the forms.

The Determination of Taxability Form can be found on B&F website under policies and forms.

Who can I contact if I have any questions?

Contact tax@osu.edu with any questions.

How is fair market value (FMV) determined?

In general, fair market value is determined on the basis of all the facts and circumstances. Specifically, the fair market value of a fringe benefit is the amount that an individual would have to pay for the particular fringe benefit. In instances where the university purchases an item of clothing from a vendor, the cost incurred to purchase the item is the FMV.

How is FMV determined when cost is not available or no cost was incurred (i.e. Athletics Nike contract, donated items given to employees that have value)?

When the university provides items to employees where no cost, or discounted cost, was incurred, the employee still receives value. FMV can be determined by the retail cost to the employee to purchase same item. Where this is not readily determinable, consult Tax Office for assistance.

How will I be taxed on the clothing?

The fair market value of the clothing will be added as income once the De Minimus threshold is met of $100 per year and will be included in your next available payroll check. This will allow for the appropriate taxes to be withheld in accordance with IRS regulations.

How do I know if the clothing issued meets IRS requirements for exclusion?

The requirements review is performed on a case by case basis. An example is a police officer or firefighter uniform; it is not adaptable for everyday wear. However, a police detective's suit jacket and related clothing, since they are suitable for everyday wear, do not qualify as a non-taxable benefit and are taxable to the employee.

When should a Determination of Taxability Form be completed?

All instances of providing clothing to employees must be taxed unless an exclusion is requested by the unit and confirmed by Tax Office. Final determination of an exclusion by Tax Office will be made once a completed Determination of Taxability Form is received. The determination is applicable indefinitely unless the circumstances (items or usage) have changed. For example, a determination of taxability issued in the past excluding taxation of medical scrubs, would apply to new purchases/rentals of medical scrubs in the future.

What are some examples of clothing considered non-taxable?

Examples of University wide non-taxable clothing include lab coats, scrubs (standard top and bottom only), and regalia.

What are some examples of clothing considered taxable?

Examples of taxable clothing includes shirts (logo or plain polo, tee, button down), pants, shorts, athletic clothing, shoes, boots, jackets, hats, etc.

What if I receive a clothing allowance through my paycheck and am not issued the clothing directly?

Clothing allowances are always taxable when paid through your payroll check. There is no exemption even if the money is spent on items that meet the excludable requirements.

Who should I ask about the taxability of clothing provided?

Your department will be able to help answer if clothing issued will be treated as a taxable fringe benefit.

If I'm required to wear certain clothing for work, why must I pay tax on it?

The IRS requires us to tax all items given to an employee unless there is a defined exclusion. Clothing must meet the IRS rules for exclusion to be treated as non-taxable.

How do I know if the clothing issued is required to be worn?

Your department will be able to inform you if any clothing provided is required to be worn.

Who can run the Comp Time Aging for Cost Centers report?

Managers, Cost Center Managers, and HR professionals can all run the Comp Time Aging for Cost Centers report to assist their area. Anyone who can currently run the Time off Liability – OSU report will have access to this new report.

Can I ask for my balance to be paid out sooner than it will age out?

No, requests for compensatory time payouts cannot be accommodated.

Why do I see negative accruals on my compensatory time off when I run the View Time Off Results by Period report?

When comp time becomes over 365 days old, it shows as a negative accrual on your compensatory time off balance, and a positive accrual on your compensatory aged payout balance.

How long do I have to use comp time before it pays out?

You have until the last day of the pay period containing the 365th day after it was earned to use it before it is paid out.

When do I have access to my money?

Your net pay will be deposited by the opening of business on the morning of payday and the full amount deposited is immediately available in your account

How often will I have a problem with Direct Deposit?

Problems with Direct Deposit are rare since your payment is sent electronically to your banking institution.

What happens if I change banks?

Log in to Workday and update your Direct Deposit/Payment Election with your new bank information. Detailed instructions can be found at Manage Payment Elections.

What account will my reimbursement from the Travel Office be deposited to?

Reimbursements issued by the Travel Office are direct deposited into the account you designated as your Expense Account in Workday. Here are the instructions for Manage Payment Elections.

What does "deposit order" mean?

Order of deposit is meant for those with multiple deposit accounts and is the order in which you want your pay deposited into your accounts.

If you have more than one account, use the arrows in the Order column to dictate the order in which your money should be deposited into the accounts.

What does "balance of net pay" mean?

The term "balance of net pay" means that if you have only one account set up for direct deposit, the full amount of your pay check will be deposited into that account. If you have multiple accounts set up, this is the last account your check will be deposited into on pay day.

If I terminated my employment and was later rehired, will my payment election information still be active?

Your payment election information is inactivated twenty (20) weeks after you terminate your employment with the university.

How many Direct Deposit accounts can I have?

You can elect to have your pay direct deposited in up to ten (10) accounts.

Can Payroll take money out of my account?

Generally, no. However, if Payroll pays you too much (e.g., you were paid for too many hours or we sent two deposits to your account for one pay period), Payroll can reverse the incorrect payment, without notifying you, within five business days of making the payment.

Why do some employees on direct deposit have their money earlier than others?

Some institutions post funds to accounts at the beginning of the bank's business day, while others post the funds in the afternoon.

What happens if I closed my bank account, but didn’t cancel my direct deposit or notify payroll?

The financial institution will return the money to Ohio State, usually within 2 - 4 business days as "account closed." Payroll Services will inactivate the direct deposit account and reissue the payment. Before an account is closed, the employee should update their payment election information in Workday.

I am a new hire/rehire, when can I set up my direct deposit?

You can set up your Payment Elections once your information has been entered into Workday.

Can I still get paid without having direct deposit set up?

Yes. if you don’t have direct deposit set up, Payroll will issue you a pay card that will be mailed to the home address you have in Workday.

If I have direct deposit set up on BuckeyeLink for student financials, do I have to set up direct deposit in Workday for my paycheck?

Yes, they are two separate systems, so you need to set up your direct deposit information in both places.

Can I stop this week's direct deposit?

Depending upon how soon your next payday occurs, we may not be able to stop the direct deposit. Please submit a ticket through HR Connection for assistance.

I am leaving the university and moving out of the country. How do I get my last pay if I close my bank account?

You want to leave your bank account open until you have received your last paycheck. If you have already closed your account, submit a Direct Deposit/Pay Card ticket through HR Connection.

I have fraud on my bank account(s). What do I do?

Submit a Direct Deposit/Pay Card ticket through HR Connection for fraud or theft related questions and issues.

Are Graduate classes for employees taxable?

Yes. Any graduate tuition assistance fees paid by the university in excess of $5,250 per calendar year is taxable based on your current W-4 exemptions.

Are Graduate classes for dependents taxable?

Yes. All graduate classes for dependents are taxable. There is no exempt amount for dependent tuition benefits.

Are Undergraduate classes taxable for dependents?

If the dependent cannot be claimed on the employee’s current year federal tax return, then undergraduate dependent tuition is taxable.

Are Undergraduate classes taxable for employees?

No. Undergraduate classes are not taxable, unless the employee is a graduate level student taking undergraduate courses.

How do employees sign up for classes?

Review the Faculty & Staff Tuition Assistance guidelines on the Human Resources website and University Registrar’s website.

How do employees sign up their dependents for classes?

Employee fills out an on-line application from Human Resources website, retirees must fill out a paper form from Human Resources.

Do employees have to fill out an application to be eligible for classes?

No application is required for employees. They may register for classes on the University Registrar’s website.

If an employee disagrees with the amount they are charged for fees, who do they notify?

Employees may notify University Bursar at bursar@osu.edu or call 614-292-1056

If an employee disagrees with the fees category being billed (graduate or undergraduate), whom do they contact?

Employees may notify University Bursar at bursar@osu.edu or call 614-292-1056

My classes are being billed at a non-residency rate instead of residency. Who should I contact? Will the fees be corrected for retro amounts?

Contact the Bursar’s office at 614-292-1056. Previous semester fees are not corrected.

If the classes I am taking are a job requirement, do I have to pay taxes?

If you are a graduate student taking classes, you must pay taxes on any education assistance received over $5,250 per calendar year.

Where can the employees view their total fees by semester?

Through Buckeye Link.

What is the One Big Beautiful Bill Act?

Signed into law on July 4, 2025, the One Big Beautiful Bill Act (OBBBA) allows for federal income tax deductions for qualified overtime premiums and qualified tips. Eligible employees may be able to claim these deductions when filing federal income tax returns for tax years 2025 to 2028.

What does the law require from employers?

For 2025, employers are encouraged to provide employees a summary of qualified overtime and qualified tips to help them determine eligibility for the new deduction. For 2026 through 2028, these amounts must be reported using designated codes on employee W-2 forms, as mandated by federal law.

Where can I see my qualified overtime and qualified tips for 2025?

Qualified overtime and qualified tips will be reported in Box 14 on the 2025 Form W-2.

Will I see more money in my paycheck?

No, your pay will continue to be processed as usual. The new employer reporting requirements do not impact how payroll is calculated.

What are qualified tips?

Qualified tips are amounts voluntarily paid by customers as cash or credit gratuities, either directly to the employee or distributed through a tip-sharing agreement. Non-qualified tips include tips that are part of a mandatory service charge, like a banquet service charge, and non-cash tips, like a gift basket.

What is qualified overtime?

Qualified overtime is the premium (half-time) pay above your regular rate for hours worked over 40 in a workweek, as required by the Fair Labor Standards Act (FLSA). Overtime calculated using non-worked hours, such as holidays, vacation, or sick time, does not qualify.

Why does the qualified overtime on my W-2 seem less than I expected?

The qualified overtime amount in Box 14 of your 2025 W-2 may be less than expected for the following reasons:

1. The straight time portion of overtime is not included in Box 14. Qualified overtime is the premium (half-time) pay above your regular rate for hours worked over 40 in a workweek, as required by the Fair Labor Standards Act (FLSA).

For example:

- Regular rate: $20 per hour

- Overtime rate (time-and-a-half): $30 per hour

- Qualified overtime amount: $10 per hour (the additional amount required by FLSA)

2. Non-worked hours contributed to overtime, such as holidays, vacation, or sick time are not included in Box 14. As required by the Fair Labor Standards Act (FLSA), qualified overtime hours only include hours worked. Overtime calculated using non-worked hours per university policy and bargaining agreement are not qualified.

3. Overtime earned or paid as FLSA compensatory time is not included in Box 14. If you received payment for compensatory time in 2025, a portion of that payment may still qualify as overtime for tax purposes. You should discuss your specific situation with your tax advisor.

What does “overtime premium” mean?

Overtime premium is the extra half-time pay employees receive for working overtime. It is the amount paid above the regular hourly rate of pay.

Example:

- Regular hourly rate = $15.00

- Overtime hourly rate = $15.00 x 1.5 = $22.50

- Overtime premium = $22.50 - $15.00 = $7.50

Why doesn’t the year-to-date overtime amount on my payslip match the qualified overtime amount on my W-2?

Your payslip shows the full overtime pay you earned, calculated at the time-and-a-half rate. However, under the One Big Beautiful Bill Act (OBBBA), only the extra half-time premium portion of overtime is considered qualified overtime and reported separately on your W-2. In the example below, the year-to-date overtime amount on the payslip would show $225.00, of which $75.00 is the qualified overtime premium amount reportable on the W-2.

Example employee has an hourly rate of $15.00 and works 10 overtime hours in a week.

- $15.00 x 10 Overtime Hours: $150.00 straight time

- $15.00 x 0.5: $7.50 overtime premium rate

- $7.50 x 10 Overtime Hours: $75.00 overtime premium

- Paystub Total: $150.00 straight time + $75.00 overtime premium = $225 time-and-a-half

- W-2 Total: $75.00 overtime premium

Why was I paid for more overtime hours throughout the year than are included in my qualified overtime premium reporting?

According to the Fair Labor Standards Act (FLSA), overtime is based only on actual hours worked beyond 40 hours in a workweek. However, some employers may pay overtime based on company policies, labor agreements, or specific state requirements that include non-worked hours like holiday benefit pay. These additional hours may be paid for at the overtime rate, but they do not qualify for the federal overtime deduction.

Are holiday benefit pay hours included in the qualified overtime premium calculation?

No, according to the Fair Labor Standards Act (FLSA), overtime is based only on actual hours worked beyond 40 hours in a workweek. Holiday benefit pay is not considered hours worked and, therefore, does not count toward the calculation of qualified overtime premium.

If I work in a state with daily overtime laws, how does that affect the qualified overtime premium calculation?

The One Big Beautiful Bill Act (OBBBA) follows the Fair Labor Standards Act (FLSA), which defines overtime as hours worked over 40 in a workweek. Even if your state requires daily overtime compensation, only the extra half-time premium for hours beyond 40 in a workweek qualifies for the federal deduction and is reported on your W-2.

Is overtime earned in December 2024 and paid in January 2025 eligible for the 2025 federal tax deduction?

Yes, any overtime paid in 2025 is eligible for the deduction and reported on the 2025 Form W-2. The deduction applies based on the payment date, not the work date.

Will the qualified amounts on my W-2 automatically reduce my taxes?

No, the amounts reported on your W-2 are for informational purposes. Eligible employees may be able to claim these deductions when filing federal income tax returns. More information is available on the IRS website or by consulting a tax advisor.

Do the tips and overtime deduction rules under the One Big Beautiful Bill Act apply to all employees?

No, the tips and overtime deduction provisions in the One Big Beautiful Bill Act (OBBBA) apply only to employees who receive qualified overtime or qualified tips, as defined by federal guidelines.

- Employees who are exempt from overtime are not eligible for the overtime deduction. Overtime eligibility is based on the Fair Labor Standards Act (FLSA), which requires overtime pay for non-exempt employees who work more than 40 hours in a workweek.

- Employees who do not customarily receive voluntary tips are not eligible for the tips deduction. Tip eligibility is based on working in occupations that the IRS has identified as customarily and regularly receiving tips, with some exceptions. The IRS has published a proposed list of qualifying occupations.

Will I see qualified amounts on my paystub throughout the year?

No, employers are required to track the qualified amounts internally and report them annually on your W-2.

What do I do if I believe my qualified amounts are missing or incorrect?

Please submit a Payroll Inquiry case in HR Connection with a detailed description of the issue and any supporting documentation.

Where can I learn more information about this law?

More information is available on the IRS website or by consulting a tax advisor.

Why wasn’t I notified about this garnishment?

You should have received a notification from the court or agency of the garnishment filing and an email notification from Garnishments@osu.edu from Ohio State.

You can request a copy of the paperwork by sending an email to Garnishments@osu.edu. Copies of the paperwork will be mailed to your home address listed on Employee Self Service. Due to privacy restrictions, we cannot email the paperwork to you.

There is a garnishment listed on my paycheck. Who do I contact if I have questions?

Submit a garnishment ticket in HR Connection.

Will you garnish my wages every paycheck?

Yes. Each pay will be garnished until we receive a "Release Form" from the court.

Can I reduce the amount coming out of my check each pay?

The amount is set by the court or agency that manages the garnishment. You would need to contact the agency or the creditor’s attorney to discuss arrangements to reduce your payment amount.

How much will be deducted from my check because of the garnishment?

- Child support: The amount is set by the child support agency

- Bankruptcy: The amount is set by the court and approved by the employee

- Student Loan repayment: 15% of your disposable earnings (gross wages minus all taxes)

- Writ of Garnishment: 25% of your disposable earnings (gross wages minus all taxes)

My child is 18 and graduated from high school. Why hasn’t my child support stopped?

Once your child turns 18 and/or graduates from high school, the child support agency does an audit to make sure all the required payments have been received. After the audit is complete, the agency will send a release to the Ohio State payroll department. You can also contact your case worker several months before your child turns 18 and/or graduates from high school to request an audit.

Do items received by student employees need to be reported to financial aid?

No. If they are receiving the item because of their employment, then it does not need to be reported to Financial Aid Office.

Are there non-cash items that do not need to be reported?

Non-cash employee items that will not be required to be reported will include employee achievement/service awards and items addressed within the expenditure policy.

What type of non-cash items are required to be reported?

All non-cash employee prizes, gifts, tickets to events, any clothing that was not approved for exemption, etc.

Are shipping costs included in the amount taxable to employees?

No.

Are gift cards considered non-cash?

No, gift cards are considered the same as cash and are taxable in any amount.

Why am I being taxed for an item I received?

IRS requires us to tax all items unless there is a defined exclusion.

Where can I find the policy?

The Expenditures Policy outlines information related to non-cash items.

Who should I ask about the additional amount of tax withheld?

Submit a ticket through HR Connection.

Who can I contact if I have any questions?

Submit a ticket through HR Connection.

My paycheck was issued as a pay card, can it be reissued as a direct deposit to my personal account?

Can I withdraw all the money off my card at one time?

Yes. You can go to a bank that services VISA and withdraw all of your money to the penny. Inform the teller you wish to do an over-the-counter transaction, and tell them the exact amount you would like to withdraw.

See your cardholder agreement from Wisely Pay card for details.

Who do I notify about a lost/stolen pay card and how do I request a new one?

Call Wisely Pay card immediately at 866-313-6901. Submit a Direct Deposit/Pay Card ticket through HR Connection for issues related to stolen pay cards.

How do I find a surcharge-free ATM?

Wisely Pay card posts links to surcharge-free ATMs on its ATM locator webpage, which includes links to:

Do I need to have a Social Security number to get a Wisely Pay card?

Is the direct deposit process different for Wisely Pay card than into a bank account?

No, the process is the same.

When will my payroll funds be available on my Wisely Pay card?

Your funds will be available to you on payday.

Can I split my pay among several accounts and/or a pay card?

Yes. Use Workday to determine how you want to receive your pay.

After setting up a pay card, can I change my preferences?

Yes. You may adjust your direct deposit preferences at any time through Workday.

Am I required to use a pay card?

No. You may use any of the direct deposit options, which include using your checking accounts, savings accounts and the Wisely Pay card.

As of July 1, 2019, the university will not be printing paper checks, so employees who do not specify their preference by that day will automatically be sent a pay card and have their pay assigned to it. However, employees can update their direct deposit preferences at any time.

What will a pay card cost me?

There is no charge to sign up for pay cards through Wisely Pay card.

The company lists all potential transaction fees, costs, terms and conditions in its Cardholder Agreement and Disclosure form, which is delivered with your physical pay card. The instructions also explain how to avoid fees.

How do I sign up for a pay card?

Requests for pay cards can be submitted through the Employee Service Center under the Direct Deposit/Pay Card service.

Why should I sign up for a pay card?

Direct deposit has advantages over paper checks for a variety of reasons, including greater security, speed and simplicity. Starting July 1, 2019, Ohio State will pay all employees through a direct deposit option - either a checking account, savings account or pay card. (Paper checks will no longer be an option.)

You can choose the direct deposit option that works best for your situation, including splitting your pay into several accounts. A pay card is simply one of the options for direct deposit.

Wisely Pay card publishes a webpage that provides some details about its pay card system.

I am an International person, where can I find information regarding a social security number for a nonresident alien?

See the social security number questions under the Nonresident and Resident Aliens section below.

How do I enter my time worked when Workday is down?

Keep track of your check in/out time and enter in Workday when the system becomes available. For more information, please refer to the Paper Timesheet job aid on Administrative Resource Center.

How do I submit the hours I worked this week?

Campus employees submit time worked in Workday. For more information, please refer to the Time Tracking Overview job aid on the Administrative Resource Center.

Health System employees record time worked in UKG/Kronos. For more information, please refer to the UKG/Kronos Tip Sheets (Health System) job aid on MyTools.

Can my manager make changes to my hours worked or time off requests?

Yes, managers can enter or correct time and time off requests on behalf of their employees. You will receive a notification that time or time off has been submitted on your behalf and will be advised to review.

For more information, please refer to the Time Tracking for Managers job aid on the Administrative Resource Center.

Will I get paid if I do not submit my hours worked?

No, time must be submitted to be paid.

For more information, please refer to the Time Tracking Overview job aid on the Administrative Resource Center.

Where do I approve my employee's time or hours worked in Workday?

Hours worked can be approved from your Workday inbox or Time and Absence Dashboard.

For more information, please refer to the Time Tracking for Managers job aid on the Administrative Resource Center.

I have reviewed the information available here on the payroll website and in HR Connection via the link provided below and still have questions about my taxes. Who do I contact?

Contact HR Connection by submitting a Tax Inquiry through HR Connection, email hrconnection@osu.edu, or call 614-247-myHR (6947).

I work hybrid, part-time at an Ohio State location and part-time from home. My department is moving to a different Ohio State building, do I need to submit a new Flexible Work Agreement for tax purposes?

Yes, you need to submit a new Flexible Work Agreement any time you have a work address change so that you have accurate work location information on record and your taxes can be reevaluated by Payroll for accuracy.

I submitted a new Flexible Work Agreement effective mid-pay period and expected my taxes to change on that effective date. Why did they change for my whole paycheck?

For tax purposes, Flexible Work Agreement changes must be effective at the beginning of a biweekly or monthly pay period for biweekly and monthly employees respectively. If a change is made effective mid-pay period, the tax localities and percentage allocations active at the end of the pay period will apply to the entire pay period.

I transferred to a new position and had an active Flexible Work Agreement on my previous position. What happens to my taxes?

Flexible Work Agreements are by position. If you transfer to a different position and do not submit a Flexible Work Agreement for that new position, your taxes will default to the Workday location on your new position. If you continue to work in a remote/hybrid capacity on the new position, you must submit a new Flexible Work Agreement for your new position to be taxed appropriately. If you are working full-time at an OSU location different from what is currently on your new position, your manager will need to update your work location in Workday.

I had taxes withheld for a locality that I was not working in because of House Bills 197 and 110 or because my Flexible Work Agreement was completed late or was inaccurate. How do I receive a refund?

Contact the local municipality directly for more information on how to request a refund. As a reminder, you may also be required to file with the locality where you were working and/or residing but taxes were not reported or withheld.

Employees are responsible for working directly with the local municipality for any tax withholding corrections resulting from late or inaccurate location reporting, including refunds. Payroll will make the changes effective going forward on all future paychecks.

For all localities utilizing the RITA Form 10A, Payroll will complete the employer certification section:

Step 1: Submit a Tax Inquiry in HR Connection.

Note: If you are filing a Form IR-25 or CRISP form with the City of Columbus, an employer certification is not required. You can continue working directly with the City of Columbus without an employer certification.

Step 2: Attach (1) your fully completed and signed form, (2) documentation from your manager confirming your actual work location during the refund request period, and (3) a copy of your W-2 form for the tax year(s) you are requesting a refund.

Allow up to 30 days to review your request and respond. We will review the attached documentation and respond in the Tax Inquiry in HR Connection. If you are submitting a request for employer certification within 30 days of the tax filing deadline, you may want to confirm the deadline for the form you are submitting and consider filing for an extension as needed.

Work with a tax preparer or financial advisor for any questions regarding the form and personal taxes. Payroll partners are not trained tax advisors and will be unable to answer these questions.

How often do I need to review my flexible work arrangement with my manager for tax purposes?

Work locations must be reviewed quarterly to ensure accurate work address and percentage allocation are reported for tax purposes.

I submitted my Flexible Work Agreement in HR Connection, and it was approved by my manager. When will the tax deduction on my paycheck change?

If the work address(es) you reported on the Flexible Work Agreement is in a different tax municipality from your previous work location and/or your percentage allocation for multiple work locations changed, the updates will reflect on your paycheck within two pay periods. Questions regarding invalid addresses will be sent back to the employee and manager and may cause a delay in processing. Employees are responsible for working directly with the local municipality for any tax withholding corrections resulting from late or inaccurate location reporting, including refunds. Payroll will make the changes effective going forward on all future paychecks.

Is the Flexible Work Agreement form the only way to report work location(s) for tax purposes?

Employees working in a single campus location do not need to complete a Flexible Work Agreement and work taxes are based on the worker’s Location in Workday.

The work taxes on my paycheck are wrong. How do I get them fixed?

Are you working 100% in Ohio State locations?

Working in a single campus location: Work with your manager to update your location in Workday.

Working in multiple campus locations: Work with your manager to submit a Tax Inquiry in HR Connection to report the effective date, correct Ohio State locations, and percentage of time spent at each location.

Are you working hybrid or 100% remotely?

Use the Flexible Work Agreement Job Aid to submit a Flexible Work Agreement in HR Connection. You will then receive a notification from HR Connection with the terms of the agreement for your review.

Who needs to submit a Flexible Work Agreement request to report work location(s) for tax purposes?

Employees who (1) work fully remote or (2) have a hybrid arrangement working remote and at an Ohio State location. Work tax withholdings will only be accurate if the information is submitted in HR Connection using the Flexible Work Agreement form.

How are work state and work local taxes determined?

Payroll uses the location on your position(s) in Workday to determine state and local tax withholdings unless you have an active Flexible Work Agreement for telework on file for one or more of your positions. If you have a telework agreement, Payroll uses the locations and percentage allocations provided within your Flexible Work Agreement to determine tax withholdings.

NRA - General Information

How do I update my status to Permanent Resident or Naturalized citizen?

Submit a request through HR Connection and include a copy of your Permanent Resident Card or Naturalization Certificate.

I don’t have an SSN, will I still get paid?

Initially yes, while the SSN is processing at SSA, however, there are some exceptions. If an individual is not SSN eligible per their visa status, then they cannot be paid.

Are NRAs automatically exempt from FICA (Medicare) tax?

No. Your visa type determines when you are exempt and when you are taxed for Medicare.

VISA types | FICA

|

|---|---|

F-1 based on student enrollment | Exempt for the first 5 years from the date of entry; may be exempt |

J-1 Student enrollment | Exempt for the first 5 years from the date of entry; may be exempt based on student |

J-1 scholars, Research | Exempt for either the first 2 calendar years in the US, or 2 out of the first 6 calendar years in the US regardless of visa status. |

F-2, J-2, H-1B, O-1, TN | Must pay FICA (Medicare) |

Why Is My Tax Status Important?

In order to comply with the U.S. tax laws, your U.S. Tax Residency Status must be determined. The substantial Presence Test is used to determine whether an individual is a Nonresident Alien or a Resident Alien for purposes of U.S. tax withholding. Sprintax will calculate your U.S. Residency Status for Tax Purposes based on the information provided by you.

NRA - Sprintax

Where do I find the SEVIS ID?

If you are an F-1 or M-1 visa holder, your SEVIS ID is located at the top, left-hand side of your Form I-20.

If you are a J-1 visa holder, your SEVIS ID is located at the top, right-hand side of your Form DS-2019.

What is "expected gross income"?

Expected gross income is the total pay you expect to receive from all U.S. sources before taxes or other deductions.

What is " Other income (awards, prizes) (Income Code 23)"?

Prizes and awards are amounts received as prizes primarily in recognition of scientific, educational, artistic, literary, religious, charitable, or civic achievement.

What is " Compensation during studying and training (Income Code 20)"?

This category refers to compensation for personal services performed while a nonresident alien is temporarily in the U.S. as a student, trainee, or apprentice, or while acquiring technical, professional, or business experience.

What is " Compensation for teaching or research (Income Code 19)"?

Compensation for teaching or research are payments to a nonresident alien professor, teacher, researcher, or a research scholar made by a U.S. accredited educational, governmental, or research institution for teaching or doing research at, or for the institution.

What is " Compensation for dependent personal services (Income Code 18)"?

Dependent personal services are personal services performed by an individual as an employee rather than as an independent contractor.

What is " Compensation for independent personal services (Income Code 17)"?

Independent personal services are personal services performed by an independent contractor. This category of compensation includes payments for professional services made directly to the person performing the services and not through an employer.

What are "Scholarship or fellowship grants (Income Code 16)"?

A scholarship is generally an amount paid or allowed to a student at an educational institution for the purpose of study. A fellowship grant is generally an amount paid or allowed to an individual for the purpose of study or research. A scholarship or fellowship grant paid to a nonresident alien who is temporarily present in the USA may be taxable if it was used for incidental expenses, such as room and board, travel, research, clerical help, or similar expenses. These amounts must be included in the individual's gross income. In certain cases, scholarship’s paid to cover tuition related expenses can constitute taxable income as well.

Why can't I edit the first row of Visits to the U.S.?

The first table is not editable as it represents the current immigration status you described earlier on the same screen. Simply change the dates entered above, if needed. By clicking on "Add Status" for each single entry, you need to list all other visits that dated prior to your current immigration status.

What are current immigration status entry and expiration dates?

Current immigration status entry date is the date on which you entered the U.S. for the first time on your current visa(status). For the expiration date of the same, you can refer to your visa supporting documents such as I-20/DS-2019 if you are an F or J visa holder or simply enter your expected departure date on your current assignment for all other statuses.

What is "Country of residence"?

Your country of residence is normally the place where you permanently resided before entering the U.S. on your current visa/immigration status, and to which you had tighter connections to than any other place in the world.

To the question 'When did you first enter the U.S.?' should I enter my first ever visit to the U.S. or the date on which I entered with my current visa?

You need to enter the date on which you came to the U.S. for the first time ever.

What are OPT and CPT?

OPT stands for Optional Practical Training, this allows F1 - Students to work on a full-time basis for one year after they have completed their studies, in a field related to their major. CPT stands for Curricular Practical Training and allows F1 - Students to work for up to 20 hours a week in a field related to their major, while engaging in studies.

What is the Document Exchange section?

The Sprintax Document Exchange facility allows you to upload information to your account in certain format, which will also be accessible by your paying institution. Documents you can upload include all documents generated on the Tax Forms screen of your account plus anything additional requested by your payer, such as copies of your identification documents, immigration status supporting documents, and more. Make sure to select the appropriate Document Type from the Document Exchange drop-down menu.

What forms can Sprintax prepare for me?

Depending on your personal circumstances, Sprintax will generate one or more of the following forms:

Form 1042-S, Foreign Person's U.S. Source Income Subject to Withholding, is the official income reporting document that a payer provides to a foreign payee of an income and to the IRS. A form 1042-S is used to report tax treaty exempt wages, scholarship grants and fellowships, independent personal services income, royalties, other income including awards, prizes, lottery/gambling winnings, deposit interest, etc. made to a foreign person.

- Form W-4, Employee's Withholding Allowance Certificate, is submitted by an employee to their employer for the correct withholding of federal income tax from their pay. Form W-4 should be signed and provided to the payer before the start of their work assignment or before their first pay.

- Form W8-BEN, Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting (Individuals), is provided by a non-resident alien, the owner of income subject to withholding, to the withholding agent or payer. Form W8-BEN should be signed and provided to the payer before a payment is made.

- Form W-9, Request for Taxpayer Identification Number and Certification, is provided to a payer to verify taxpayer identification number of a U.S. person (including resident aliens) and to request certain certifications and claims for exemptions. Form W-9 should be signed and provided to the payer before a payment is made.

- Form 8233, Exemption from Withholding on Compensation for Independent (and Certain Dependent) Personal Services of a Non-Resident Alien Individual, is used by non-resident alien individuals to claim exemption from withholding on compensation for personal services because of an income tax treaty. The form should be signed and provided to the requester before the start of their work assignment or before their first pay.

- Form W-7, Application for IRS Individual Taxpayer Identification Number. The form is to be signed and sent along with supporting documents to the Internal Revenue Service.

- Form 1042-S, Foreign Person's U.S. Source Income Subject to Withholding, is the official income reporting document that a payer provides to a foreign payee of an income and to the IRS. A form 1042-S is used to report tax treaty exempt wages, scholarship grants and fellowships, independent personal services income, royalties, other income including awards, prizes, lottery/gambling winnings, deposit interest, etc. made to a foreign person.

What are FICA taxes?

The Federal Insurance Contributions Act (FICA) tax, a kind of payroll tax, is a U.S. employment tax imposed in an equal amount on employees and employers to fund federal programs for retirees, the disabled, and children of deceased workers. The FICA taxes and benefits consist of two parts: Social Security benefits, that include old-age, survivors, and disability insurance while Medicare provides hospital insurance benefits for the elderly and younger people with disabilities.

Are you legally allowed to work?

You are considered legally allowed to work if you hold a work-related visa. As a student, you are considered to be allowed to work if you are permitted to work part-time by your paying institution, such as a college or university.

What are mailing and residential addresses?

The address that should be listed on all tax related forms the mailing address. While residential address is the address where you currently or permanently reside.

What are SSNs and ITINs?

An SSN is a Social Security Number issued by the Social Security Administration to all legal aliens allowed to work in the U.S. An ITIN is a nine-digit number issued by the Internal Revenue Service (IRS) to individuals who are required, for U.S. federal tax purposes, to have a U.S. taxpayer identification number but who do not have and are not eligible to get a Social Security Number (SSN).

What is the difference between a "visa" and an "immigration status"?

A visa is a travel document that is issued by a consulate to someone who wishes to visit the United States. A visa is placed in your passport and shows the Visa Type, such as F-1, E-2 or H-1B and it allows a person to enter the United States at a port of entry (e.g. an airport).

An immigration status refers to the classification under which the person entered the United States (F-1, E-2, H-1B, etc.) and the length of time the person is permitted to stay in the United States. The status is based on regulations and is referred to as a set of rights and responsibilities an individual has toward the government.

Expiration of Visa vs. Expiration of Status

A visa is only an entry document and can expire while you are in the U.S. If your visa expires while you are legally present in the U.S, as long as your status remains valid and you continue to follow all immigration regulations, you may continue to stay in the U.S. Your status does not end upon expiration of your travel document.

I am on a J-1 visa, where can I find my immigration status?

J visa holders can check their current immigration status in box 4, Exchange visitor category, on their Form DS-2019.

What is "Immigration status"?

"Immigration status" refers to the way in which a person is present in the United States. If not a U.S. citizen, every person who enters the U.S. has either an immigrant or a nonimmigrant status. Below are examples of the documents that can be used to determine your immigration status:

- Certificate of Eligibility for Non-immigrant Student Status - I-20

- Certificate of Eligibility for Exchange Visitor (J-1) Status - DS-2019

- Employment Authorization Card - I-766

- Notice of Action - I-797

Immigration status is determined based on your occupation. Common immigration statuses include F1 - Student, J1 - Teacher/Researcher, J1 - Trainee, etc.

TIP: If you are under the visa waiver program and you are present in the U.S. for the primary purpose of studying, and have I-20, your immigration status is F1 Student.

Resident vs. Nonresident alien

You are either resident, nonresident or dual-status alien based on the Substantial Presence or Green Card tests. Residents are taxed in the same manner as U.S. citizens. Nonresidents are taxed on U.S. income only and dual-status aliens are taxed as residents during their Resident period and as nonresidents during their Nonresident period.

Who is considered an "Exempt individual"?

"F", "J", "M", "Q" visa holders do not count days of presence towards the substantial presence test for the period they are considered exempt individuals (For example: F1 students are exempt from SPT rules for the first 5 years. The exemption applies once in a lifetime).

What are the Substantial Presence Test and the Green Card Test?

The Internal Revenue Service (IRS) method for determining residency for tax purposes based on either presence in the U.S. or holding a Lawful Permanent Residency.

How can I get help?

The Sprintax team is ready to help! Ask us anything via our online chat system or email calculussupport@sprintax.com if you have questions.

If I make an error, what can I do?

You can log into your Sprintax account and correct your details. You must click "Save and continue" to save the changes.

What documents/information might be helpful when completing my online account?

When completing your Sprintax profile, keep the following information available, if it applies to you.

- Passport and U.S. Visa (if applicable)

- History of your previous U.S.immigration statuses

- U.S. TIN (SSN or ITIN), if any

- Form DS-2019 Certificate of Eligibility for Exchange Visitor (J-1) Status (applicable to J visa holders)

- Form I-20 Certificate of Eligibility for Nonimmigrant Student Status (applicable to F and M visa holders)

What do I do if I am a Permanent Resident Alien (have a green card)?

If you have a green card and receive an email about SPRINTAX, please email HRConnection@osu.edu with a copy of your green card.

What’s a Tax Treaty?

A Tax Treaty is an agreement between the United States and other countries. Currently there are approximately 66 different tax treaties in effect. Some of the tax treaties allow a student/researcher/scholar to receive income in the US without it being taxed by the federal government. There are several limitations on this benefit such as the amount of money received, the time you receive the money, your length of stay in the US, your visa status, the status in which you entered the US and others. To determine if you are eligible for a tax treaty you will need to complete your profile and submit your documents and signed forms in the SPRINTAX CALCULUS system.

What do I do with the ITIN (Individual Taxpayer Identification Number) once I receive it?

Once you have received your ITIN number, please report this number to:

- Log in to your Sprintax profile and update your number.

- Ohio State Human Resources: Log in to your Ohio State Workday account and update your number. Read instructions. If you have any questions, email HRConnection@osu.edu.

What’s an ITIN number? Is it the same as a Social Security Number?

An ITIN (Individual Taxpayer Identification Number) is a number assigned by the Internal Revenue Service, not the Social Security Administration. It is not the same as an SSN, an ITIN is not to be used for employment purposes. An ITIN number is only used for tax purposes. That is, in order to be employed you need an SSN. If you are just receiving a scholarship or fellowship and are not employed otherwise, then you need an ITIN.

You must apply for an ITIN using a form W-7. The W-7 is available on the IRS website at www.irs.gov, click on Forms and Instructions then Forms and Instruction Number and scroll to the W-7 form. The W-7 form must be mailed to the IRS office at the address in the instructions with the W-7 form. You cannot take it to the IRS office nor is it to be mailed to the OSU Payroll Department. The IRS is the agency that issues the ITIN. Do not send original documents with the W-7 form and insure that you follow the directions in the instructions for additional documents you must attach to the W-7 – some of which may require they be notarized by a notary public. You will also need a letter from the Office of International Affairs to accompany your form W-7 stating you are not employed by the University and do not qualify for an SSN.

What do I do with the Social Security Number once I receive it?

Once you have received your Social Security number, please report this number to:

- Sprintax: Log in to your Sprintax profile and update your number.

- Ohio State Human Resources: Log into your Ohio State Workday account and update your number. Read instructions. If you have any questions, email HRConnection@osu.edu.

Do I need a Social Security Number?

If you are employed at OSU you will need a Social Security Number (SSN). If you don’t have an SSN you will need to apply for one from the Social Security Administration. This is done by completing Form SS5, Application for SSN.

You can apply in person at the local Social Security Office. The Form SS5 is available on the Internal Revenue Service website at www.irs.gov, click on Forms and Publications, then Form and Instruction Number, and scroll through a listing of form numbers until you see Form SS5. You will receive a receipt from the Social Security Administration at the time of application. Approximately six to eight weeks later you will receive the actual SSN. You will also need a letter from the Office of International Affairs with the SS5.

If you are not employed by OSU (for instance, only receiving a scholarship or fellowship with no work or service requirement you are not eligible for an SSN and you will need to apply for an ITIN (Individual Identification Number) from the Internal Revenue Service – see below, “What's an ITIN Number?”.

How often do I have to access SPRINTAX?

For most students/scholars, in your first year, you will need to access SPRINTAX at least two times. The first time is to create your record in SPRINTAX and to prepare all the forms necessary to take advantage of a tax treaty. The second time you will need to access SPRINTAX is to ‘renew’ your tax treaty. The forms produced by SPRINTAX are only valid for one year, thus, they need to be completed each year.

You may also access SPRINTAX at any time to update your information – for instance, if your Visa status changes, if your address in the US changes, if your anticipated departure date changes. It’s a good idea to review all the information in SPRINTAX when you are doing your tax treaty renewal each year.

You will also want to access SPRINTAX one last time – when you leave OSU. Just indicate that you are receiving no payments of any kind and submit the record. This will stop reminder emails to you when it is no longer necessary for you to have a record in SPRINTAX .

What happens if I don’t complete my SPRINTAX profile?

SPRINTAX prepares all the forms necessary to take advantage of a tax treaty between the US and your country of residence. Without the completion of SPRINTAX the maximum amount of federal tax must be withheld from your payment. If you are employed by OSU and do not complete your SPRINTAX profile, the rate of tax to be withheld from your paycheck is set by law at 30%. If you are receiving a scholarship or a fellowship, the rate of tax is set by law at 14%.

Why should I complete the questions asked of me in the SPRINTAX system?

Since you may be eligible for the benefits of a tax treaty between your home country and the US, you will want to complete your SPRINTAX profile. The benefits of many tax treaties allow you to be exempt from federal tax on your payments from OSU. Note: The mere existence of a tax treaty between the US and your home country does not guarantee that you are eligible to receive this benefit. You must qualify for the tax treaty before you can receive any benefit of a tax treaty. Note: A tax treaty between the US and your country of residence only applies to federal tax, it does not apply to state – (however, the State of Ohio currently honors the tax treaties), city tax or Medicare tax – so even if you qualify for the benefit of a tax treaty with your home country there will still be other tax deductions from your paycheck.

How do I update my visa/immigration information?

Update your information in SPRINTAX and submit a request through HR Connection with a copy of your updated paperwork.

Will I still get paid if I haven’t submitted my Sprintax forms?

NRA - Filing Taxes in the U.S.

Am I required to file IRS Form 8843, Statement for Exempt Individuals and Individuals with a Medical Condition?

All nonresidents must file IRS Form 8843 regardless of whether they had U.S. source income. Those who did earn U.S. source income must also file IRS Form 1040‑NR.

What if I didn't file taxes last year?

You must prepare a separate tax return for each tax year. Since tax year 2025 is the first year Ohio State is using Sprintax Returns, you must go to the IRS website, Prior year forms and instructions and download/print Form 1040-NR, Instructions for Form 1040-NR and Form 8843 to complete prior year tax returns.

As a Nonresident Alien am I required to file a tax return with the federal government each year?

Yes, you are required to complete a form and file it with the Internal Revenue Service each year. These returns are due to be filed each year by April 15.

If you are filing Form 8843 only, the deadline to file is June 15.

FICA Tax and Exemptions

General Student FICA exemption:

FICA taxes do not apply to payments received by students employed by a school, college, or university where the student is enrolled full time and pursuing a course of study.

International Student and Scholar FICA exemption:

International students, scholars, professors, teachers, trainees, researchers, physicians and other nonresident aliens for tax purposes present in the United States in F-1, J-1, M-1 or Q-1/Q-2 nonimmigrant statuses are exempt from FICA taxes on wages.

Limitations on FICA exemption for International Persons:

- The FICA exemption does not apply to spouses and children in F-2, J-2, M-2, or Q-3 nonimmigrant status.

- The exemption does not apply to F-1, J-1, M-1, or Q-1/Q-2 nonimmigrants who change to an immigration status which is not exempt or to a special protected status.

- The exemption does not apply to F-1, J-1, M-1, or Q-1/Q-2 nonimmigrants who become resident aliens.

- The FICA exemption only applies to international persons in F-1, J-1, M-1, Q-1, or Q-2 visas and who are still classified as nonresident aliens for tax purposes under U.S. tax regulations.

- International students in F-1 and J-1 nonimmigrant status are entitled to the FICA exemption for the first 5 calendar years of physical presence in the United States. After this period of time has passed, international students are classified as Resident Aliens for Tax Purposes and are subject to FICA tax withholding. However, if they remain students (primarily) they may be able to claim the Student FICA exemption.

- The five-year exemption permitted to F-1 and J-1students also applies to any period in which the international student is in "optional practical training" allowed as long as the foreign student is still classified as a nonresident alien for tax purposes.

- International scholars, teachers, researchers, trainees, physicians, other non-students in J-1, Q-1 or Q-2 nonimmigrant status who have been in the United States less than two calendar years are classified as nonresident aliens for tax purposes and are exempt from FICA taxes for that two-year period of time. However, once the two calendar years have passed, this group of international persons is classified as resident aliens for tax purposes and is subject to FICA tax withholding.

- Spouses and dependents of alien students, scholars, trainees, teachers, or researchers temporarily present in the United States in F-2, J-2, or M-2 status are NOT exempt from Medicare taxes, and are fully liable for Medicare taxes on any wages they earn in the United States. International persons in H-1B, TN, O-1 or E-3 status are fully subject to FICA tax withholding. No FICA exemption is available to persons in these visa categories.

Form 8843 - Instructions for required fields

- Download the Form 8843 off the IRS web site

- Fill in your name exactly as it appears on your passport

- For the box requesting your U.S. taxpayer identification number, write in your Social Security or Individual Taxpayer Identification Number (ITIN). If you do not have either one of these, leave it blank.

Part I: General Information

Required for: Everyone completing Form 8843

- 1a Enter your status (i.e. F-1, J-2, H-1B, etc.) that you used to enter the U.S. most recently and the date you entered

- 1b Your current nonimmigrant status should be the same as #1a unless you changed status while in the U.S. If you requested a change of status (e.g. you entered the U.S. in H-1B status and without leaving changed to F-1) in the U.S. enter your current non-immigrant status (F or J) and the date that your change of status was approved (see I-797 form). Otherwise, all you need to do is enter your current non-immigrant status as you stated in #1a; no date is required.

- 4a Count the number of days you were physically present in the U.S. in each of the last 3 calendar years. Make sure to enter the actual number of days you were present. Exclude days when you were outside of the U.S.

- 4b Substantial Presence Test: enter the number of days you were present in the U.S. during the tax year. This should be the same number that you entered in the first blank on #4a.

Part II: Teachers and Trainees

Required for: J-1 Research Scholars', Sort-Term Scholars, Professors and Specialists ONLY. See box #5 on your DS-2019 for category. Do not fill out if you are a 'J-1 Student' or 'F-1 Student'.

- 5 Enter: The Ohio State University 2650 Kenny Road, Columbus, OH 43210

- 6 – 8 Answer each question according to your individual situation.

Part III: Students

Required for: F-1 and J-1 Students (and F-2/J-2 dependents) ONLY

9 Enter: The Ohio State University 2650 Kenny Road, Columbus, OH 43210

- F-2/J-2 Dependents write: Spouse/Dependent of student attending The Ohio State University 2650 Kenny Road, Columbus, OH 43210

- 10 Enter: Amanda Yusko 2009 Millikin Road Columbus, OH 43210 PH#614-292-6101

- F-2/J-2 Dependents write: Spouse/Dependent of student attending The Ohio State University whose Program Director is Amanda Yusko 2009 Millikin Road Columbus, OH 43210 PH#614-292-6101

- 11 – 14 Answer each question according to your individual situation.

Part IV: Professional Athletes

Leave all spaces blank. Does not apply to those present in the U.S. in F or J non-immigrant status.

Part V: Individuals With a Medical Condition or Medical Problem

Leave all spaces blank. Does not apply to those present in the U.S. in F or J non-immigrant status.

Signature Section

Required for: Everyone completing Form 8843

- Sign and date the bottom of page 2

Deadline for submitting the forms:

If you are filing the Form 8843 only, the deadline to file is June 15.

Tax Treaties

The United States has tax treaties with a number of foreign countries. Under these treaties, residents of foreign countries are taxed at a reduced rate, or are exempt from U.S. federal and state taxes on certain types of income and/fellowship payments they receive from sources within the United States. These reduced rates and exemptions vary among countries and specific types of income. If the treaty does not cover a particular type of income, or if there is no treaty between your country and the United States, you must pay tax on that income. For the list of tax treaty countries and their treaties, reference the IRS Publication 901.

What are Income Codes?

The income code defines the type of income.

- 10 Industrial Royalties

- 12 Other Royalties (for example: copyright or software)

- 16 Scholarship or Fellowship

- 17 Independent Personal Services

- 18 Dependent Personal Services (generally limited to individuals from Canada)

- 19 Teaching or Research

- 20 Studying and Training

- 23 Other Income

- 42 Payments to Performers/Artists

- 43 Payments to Performers/Artists (signed Central Withholding Agreement required)

Where do I mail my tax return?

Form 1040-NR and Form 8843 should be mailed to:

Internal Revenue Service Center

Austin, TX 73301-0215

Nonresident alien for Tax Purposes

Federal

If you are in F, J or H status and a nonresident alien for tax purposes:

If you received U.S. source income in the current calendar year, you are required to file a federal tax return with the IRS (Internal Revue Service). You must complete and mail IRS Form 1040-NR and IRS Form 8843. You must file a federal tax return form even if your employer deducted ("withheld") money from your paycheck for federal taxes. The amount that is deducted from your paychecks is an estimated amount, so you may in fact, owe tax if an insufficient amount was withheld based on the IRS standard amounts. If the estimated amount deducted from your paychecks is higher than what you should have paid based on the IRS standard, you may receive a refund of taxes. Therefore, you must file a tax form to calculate the difference between what you owe and what you paid. Even if a tax treaty was applied to your paychecks during the year and the amount you owe in taxes is reduced or eliminated, you are still required to file a federal tax return with the IRS. You would file IRS Form 1040-NR and Form 8843. Not filing a tax return is a violation of U.S. tax law.

Filing tax documents each year is an important part of maintaining your immigration status and is a federal requirement for international visitors and their dependents. Not filing your required taxes documents could lead to penalties, such as a fine, or even negatively impact your immigration status.

If you apply for future immigration benefits, such as H-1B, Permanent Residency, or other statuses, you will likely be asked to provide copies of tax filings for all previous years you were in the U.S. If you forgot or didn't file in previous years when you should have, the IRS recommends that you file now for previous years. You can find the relevant forms from past years on the IRS website. The IRS expects you to file your taxes each year--even if you file late. Penalties for late filing may include fines, interest on taxes owed, or other consequences.

Form 8843

IRS Form 8843 is a tax form used by foreign nationals to document the number of days spent outside of the U.S. and to help determine tax responsibility. All F and J foreign nationals (and their F-2/J-2 dependents) who are nonresident aliens for tax purposes are required to file Form 8843. You will file this form whether or not you received income or are filing a tax return. You must file Form 8843 if BOTH of the following conditions are met:

- You were present in the U.S. in F/J status for any portion of the previous calendar year (the year for which you are filing)

- You are a nonresident alien for tax purposes.

Dependents (including children, regardless of age) should complete a separate Form 8843 independent of the F-1/J-1.

State

Some international students and scholars are required to file a State of Ohio Tax Form that can be found on the Ohio Department of Taxation website. If you worked in more than one U.S. state during the past calendar year, you may have to file tax returns in all the states in which you resided or worked. You should check the state revenue website of the other state(s) where you worked or lived for assistance in determining your tax filing obligations.

City/Local

Some cities require completion of a tax return for all residents. You should check with the city you live in.

Residency and Non-Residency for Tax Purposes

U.S. tax law categorizes people as resident aliens or nonresident aliens for tax purposes only, which is not necessarily the same as residency according to immigration law. Resident aliens for tax purposes follow the same rules as U.S. citizens for taxation. For a nonresident alien for tax purposes there are special taxation rules that apply. There are also special rules that apply specifically to F-1 students, J-1 students and scholars and H-1 employees who are nonresident aliens for tax purposes. These tax statuses are significant because filing under the incorrect tax designation may result in taxes owed back to the government. So, it is important to know your status to file correctly. Nonresident aliens for tax purposes are taxed on U.S. source income.

The U.S. Department of Treasury Internal Revenue Service Publication 519 explains the rules used to determine tax residency for those who are not U.S. citizens.

I am a student from India. Can I claim the standard deduction?

Yes. Due to a tax treaty provision, ONLY students from India may claim the standard deduction on the nonresident forms. Note: Visiting Scholars and Researchers from India cannot claim the standard deduction.

I have a student ID starting with the numbers 997 or 998 that looks just like a social security number. Can I use this number as my taxpayer identification number?

No. You must have valid social security number or an ITIN (Individual Taxpayer Identification Number).

I just received my W-2 form for the wages I earned last year. Can I file my taxes now?

Not necessarily. If you are from a country which has a tax treaty with the U.S., or you received a U.S. based scholarship or fellowship, you may also receive Form1042-S electronically, if you elected this option in SPRINTAX. This form is generally made available to you by March 15 and you will need both forms before you can file.

I am a nonresident alien for tax purposes. Can I claim the HOPE or the Tuition Tax Credit or the Earned Income Credit?

No. Nonresident aliens cannot claim the HOPE or Tuition Tax Credit or the Earned Income Tax Credit. Once you qualify to file as a resident alien for tax purposes, you may be eligible to claim these credits.

I only worked for a very short time during the year and I didn’t earn very much. Do I still have to file?

Yes. If you had any U.S. source earned income, you will need to file IRS Form 1040-NR and Form 8843.

I only arrived in the U.S. in December and I didn’t work. Do I still have to file Form 8843?

Yes. If you were in the U.S. even 1 day, you must file Form 8843.

I’m an F-1 or J-1 student and I had no U.S. earned income or scholarships for the year. Do I need to file?

Yes. You must file IRS Form 8843. Dependents in F-2 and J-2 status must also file Form 8843.

I’m a nonresident alien and I received a prize or award and federal tax was withheld from it – I’m covered under a tax treaty, why was tax withheld?

There is no exclusion under any tax treaty from federal tax on prizes and awards given to nonresident aliens. Scholarships and Fellowships are often referred to as an award but there is a distinction between prizes and awards and scholarships and fellowships.

Where can I find additional information about my tax responsibilities?

You may view information about foreign taxpayers at the IRS web page for international individuals. You may also view and print Publication 519 from the IRS. You may also review the Office of International Affairs.

What is the deadline for filing my tax return?

If you are filing Form 1040-NR, the deadline to file is April 15. If you are filing Form 8843 only, the deadline to file is June 15.

Can I e-file my returns?

Sprintax Returns allows certain eligible nonresidents to e-file their federal tax return only. You can learn more about Sprintax Returns’ e-filing capabilities and who is eligible to e-file their federal tax return on the Sprintax Returns website.

If e-filing is available for you, you will not be required to send any hard copy documentation to the IRS to support your federal tax return unless specifically instructed to do so by the Sprintax software. You will still need to keep a copy of your tax reporting documents and tax return for your personal records.

You can also complete, sign, and mail your federal forms to the following address instead of e-filing:

Form 1040NR and Form 8843 should be mailed to:

Internal Revenue Service Center

Austin, TX 73301-0215

I’m unable to file my taxes by the deadline. Can I get an extension?

It is possible to file IRS Form 4868, “Extension of Time to File” which extends the deadline to file until August 15. If you owe any taxes though, you must still mail your estimated tax payment by April 15 or you will incur penalties and interest charges as of April 15 on any payment owed.

Should I keep copies of my tax returns and other tax forms?

Yes. Always keep copies of your tax return, W-2, 1042-S, bank interest statements and any other pertinent forms as proof that you have filed. The IRS can audit individual returns for up to 3 years following the filing deadline and your tax records are essential in assisting you in an audit.

I'm leaving the country before I can file my taxes. What should I do?

Make sure you have updated your foreign address in Workday so that your Form W-2 and/or Form 1042-S can be mailed to you if you requested this option. W-2 Forms are distributed electronically and Forms 1042-S can be distributed electronically if you opted for this delivery method. Download the appropriate forms and instructions from the IRS website and file your US taxes from abroad. Save copies of all forms submitted for your tax records.

About U.S. Taxes

The United States has several different sets of tax laws. Federal tax law applies to taxes paid to the United States government. State tax laws apply to taxes paid to the state in which you work and/or live. In some places there may also be local or city taxes. It is important to comply with all federal, state, and local tax laws that apply to you.

The federal and state tax system is based on a graduated tax system, which means that the percentage of tax a person pays is dependent on the amount of income they earn and the number of dependents they have (nonresident aliens can only claim one dependent, unless they are a resident of Canada, Mexico, South Korea or student from India). If you earn a smaller income, you pay a smaller percentage in tax, but if you earn a larger salary, you pay a higher percentage. The local or city taxes (work location) are not on a graduated tax system. Most local taxes are withheld based on a fixed percentage. For example, Columbus taxes are a fixed 2.5 percent.

I received money from sources outside the U.S. Do I have to report it and/or pay tax on that money?

Nonresident Aliens are not required to report or pay tax on money that they received from sources outside the U.S. If you remain in the U.S. long enough to become a Resident Alien for Tax purposes, then income from ALL sources (both U.S. and foreign) must be reported on the U.S. tax return.

I didn’t receive any money, do I have to file a tax return?

The requirement to file a federal tax return is based on receiving income from U.S. sources – not on receiving “money.” Income can include, but is not limited to: wages, salary, free housing, travel to/from a conference, scholarship, stipend, per diem, prize, award, gambling winnings – income does not have to be paid to you as a check or cash. Generally, if you did not receive any income from U.S. Sources, you are not required to file a U.S. tax return; however, if you are a Nonresident Alien who is present in the U.S. under an F, J, M or Q immigration status, you are required to file Form 8843, regardless of whether or not you have received any income.

Am I required to have an SSN or ITIN (a U.S. Tax Identification Number) to file my tax return?

Any individual who works in the U.S. as an employee is required to apply for an SSN; if an individual does not work as an employee, he or she cannot apply for an SSN. Any individual who receives income from U.S. sources must file a tax return and everyone who is required to file a tax return must have either an SSN or ITIN.

Can I send different tax forms together?

If you are filing by mail, you should send tax returns, related forms and any tax payments in separate envelopes to the address indicated in the instructions for the form.

Do not send your state income tax return with your federal tax return.

Do not combine tax payments owed for multiple years on one check. You must send a separate tax return and check for each year.

I have a child who is a U.S. citizen with a Social Security number. Can I claim him/her as a dependent on my tax return?

If you are a nonresident alien, you may be able to claim dependents if you are in one of the following categories:

- A resident of Canada, Mexico, South Korea or India. See IRS publication 519

Can my wife and I file a tax return together?

If both you and your wife are nonresident aliens the answer is generally NO, for federal income tax purposes. In limited cases, a spousal exemption may be claimed, but this is not the same as filing a joint return and is discussed in the “exemptions” section of the instructions for the 1040NR. State filing rules may be different.

For information on filing a joint tax return, refer to IRS Publication 519, U.S. Tax Guide for Aliens.

I'm married and have a child who was born in the U.S. Can I claim personal exemptions for my wife and child?

Generally, no. Only students & scholars from certain countries (Mexico, Canada, Japan, and India) can claim exemptions for their dependents. Specific requirements are outlined on this website.

What is a Tax Return or Tax Filing? Why Do I Need to File?

Any of your earnings in the United States are subject to applicable federal, state, and local taxes. Filing tax paperwork, such as a tax return, is a reconciliation that compares what you actually paid in taxes throughout the year to what you should have paid in taxes.

Employers and schools are required by law to withhold taxes from your paychecks or taxable stipend payments. If the taxes that were withheld from your payment are higher than what you should have paid, you will get a refund after filing your tax return ("tax refund"). If taxes were not withheld, or insufficient tax was withheld, then you will owe money at the time of filing your taxes. You declare your income and account for the taxes owed on a form or set of forms called a “tax return.”

All of my income was exempt from tax under an income tax treaty with my home country. Do I still have to file a tax return?

Yes. Even if you had no taxes withheld on your income because you were exempt from withholding due to the treaty benefit, you are required to submit a tax return to describe the treaty claim to the IRS.