Asset Management is responsible for assisting units with the tracking of capital assets, maintaining a permanent and detailed record of all capital assets owned by the university and managing an accurate system that meets the federal government's requirements and inventory audits for all capital assets.

Tools and Resources

Asset Overview

Financial stewardship for capital and non-capital assets rests with each unit and includes effective identification, tracking, physical custody, review, and disposal.

All capital assets, and trackable non-capital assets, must be tracked in Workday.

- Capital Assets - Moveable items that have a probable useful life of one or more years; have an original cost or value of $5,000 or more; and are neither permanently attached to a building or its utility systems, nor incorporated into the building at the time of initial construction or during later modifications, nor incorporated into artworks as art materials or supplies. Includes items that are leased for purchase and otherwise meet the terms of this definition. Does not include assets the university leases, subleases, or licenses under an agreement when the asset is not owned by the university, or when the asset is returned at the end of the applicable agreement.

- Trackable Non-capital Assets - Moveable items that have a probable useful life of one or more years; have original cost or value of less than $5,000; and are neither permanently attached to a building or its utility systems, nor incorporated into the building at the time of initial construction or during later modifications, nor incorporated into artworks as art materials or supplies. Includes items that are leased for purchase and otherwise meet the terms of this definition. Does not include assets the university leases, subleases, or licenses under an agreement when the asset is not owned by the university, or when the asset is returned at the end of the applicable agreement.

The value of an asset is the accumulation of all costs required to place the asset in service. This should include, but is not limited to:

- net invoice price of the asset

- cost of required attachments

- transit insurance

- freight

- installation.

Additional guidelines should be considered for Office of Sponsored Programs (OSP) assets.

Roles and Responsibilities

Roles

- Cost Center Asset Tracking Specialist (CCATS): OSU employee that is assigned by the unit leader or senior fiscal officer responsible for managing unit assets. Formerly known as Asset Coordinator. Review responsibilities.

- Asset Coordinator: primarily associated with use or possession of the asset. Formerly known as asset custodian. Review responsibilities.

- Business Asset Tracking Specialist (BATS): Central OSU employee that is responsible for asset tracking, maintenance and oversite. Review responsibilities.

Responsibilities

Cost Center Asset Tracking Specialist (CCATS)

The Cost Center Asset Tracking Specialist (CCATS) is responsible for:

- Confirming that each asset has been delivered and verify that receipt of the asset has been entered in Workday.

- Tagging the asset as soon as tags are received from the Asset Management Office.

- Entering the tag number into Workday, if necessary.

- Recording the name of the Asset Coordinator of each capital asset in Workday.

- Tracking each item of capital and trackable non-capital equipment through its lifecycle, from delivery to disposal, in Workday.

- Communicating with the Asset Coordinator regarding the location and physical condition of the asset.

- Adding/Updating location (building and room numbers) and other status detail in Workday.

- Tracking and documenting any off-campus use of an asset.

- Submitting the completed annual Annual Physical Custody Report (APCR) of capital assets by the designated deadline.

Asset Coordinator

The Asset Coordinator is responsible for:

- Verifying the physical condition and location of the asset (building and room codes).

- Advising the CCATS of any change in asset status including location, disposition, or theft.

- Notifying the CCATS when the asset has reached the end of its useful life.

Business Asset Tracking Specialist (BATS)

The Business Asset Tracking Specialist is responsible for:

- Registering assets in Workday.

- Reviewing and approving asset maintenance in Workday.

- Communicating with the CCATS regarding the management of assets.

- Managing the Asset Physical Custody Report (APCR) process.

- Reviewing and approving transfers of equipment to other departments or institutions after approval by the Cost Center Manager.

- Reviewing and approving retirements of capital equipment in Workday after approval by the Cost Center Manager.

Reporting

A variety of Asset Management reports are available in Workday. See the Reporting Summary for Business Asset Accounting job-aid in the Administrative Resource Center (ARC).

Job Aids

Job Aids at Administrative Resource Center (ARC):

- Register an Asset from Invoice

- Register an Asset from Projects Module

- Manually Register an Asset

- Creating a Bundled Asset

- Update or Make Changes to an Asset

- Transfer an Asset

- Transfer Multiple Assets

- Adjusting Assigned Accounting for an Asset

- Dispose of an Asset

- Reporting Summary for Business Asset Accounting

Processes

Asset Acquisition and Creation

As with most goods/services, assets are primarily procured via Workday with the generation of the purchase order (adhering to applicable procurement policies). See step-by-step job-aids on the Administrative Resource Center (ARC) - Supply Chain.

Payment of the invoice for the capital asset prompts the Business Asset Tracking Specialist (BATS) to register the asset, generating the asset ID in Workday and associated tag for tracking.

Any assets (capital or trackable non-capital) purchased with a PCard, must be manually registered by the Cost Center Asset Tracking Specialist (CCATS) in Workday within seven business days of the purchase transaction date for generation of the asset ID and associated tag for tracking.

For additional assistance with performing asset processes, contact Asset Management.

Receipt an Asset

Upon delivery, the capital asset must be receipted in Workday. This may be done at Central Receiving or by the Cost Center Asset Tracking Specialist (CCATS)with direct deliveries. See the Receipts – Create, Adjust, and Edit job aid at the Administrative Resource Center (ARC).

For additional assistance with performing asset processes, contact Asset Management.

Tag an Asset

For capital assets, tags will be issued by the Business Asset Tracking Specialist (BATS) to the applicable unit upon asset ID generation in Workday.

Upon receipt of the tag, Cost Center Asset Tracking Specialist (CCATS) must:

- Apply the tag to the asset.

- Enter the tag number into the asset identifier field in Workday, if necessary.

- Mark the tag as “affixed” in Workday

- If it is not possible to affix the tag to an asset due to its size, number of components, or delicate nature, the ‘additional fields – non-taggable reasons field’ must be completed in Workday, and the assigned tag must be kept with the item’s documentation in unit files for the life of the asset.

Note: Assets tags are not physically applied by Central Receiving or the Asset Management Office.

Request non-capitalized assets tags: Send email to Asset Management Office; include the requestor’s cost center number, mailing address, and number of tags needed.

Update Asset Information

Updates made to the asset’s location (e.g. building or address updates), condition, cost adjustments or other status detail changes (e.g. asset used off campus) must be documented in Workday. See step-by-step job-aid at the Administrative Resource Center (ARC): Update or Make Changes to an Asset.

For additional assistance with performing asset processes, contact Asset Management.

Retire an Asset

Disposition of an asset (e.g. retirement, sale, transfer, et al) must adhere to specific Asset Management policy criteria and be properly documented in Workday.

See the step-by-step job-aid at the Administrative Resource Center (ARC): Dispose of an Asset.

Generally, capital and non-capital assets are surplused. If this is the case, please adhere to the following 2 steps:

Step 1: Prior to placing a Surplus disposal in Workday, you will need to submit a disposal request within the Surplus Property System.

In the Surplus System, please include the most complete information (Manufacturer, Tag #, Serial # (if available), Description, etc.).

The Tag# and Serial# you list in the Surplus system must match up with the asset identifier and serial number listed in the Workday system. Once completed, surplus will provide a DR # (DR XXXXX) and they will arrange a pick-up date.

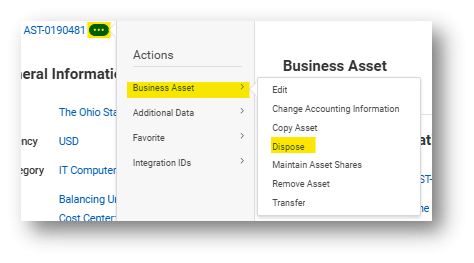

Step 2: Once the surplus personnel have hauled the asset away, you will need to submit a surplus disposal within Workday. You will start off by pulling up the asset in workday by searching for the asset ID (AST-XXXXXXX) in the search bar. Then, click on the actions button (…) next to the Asset ID (AST-XXXXXXX) and hover over Business Assets and select the Dispose function.

Lastly, please complete the 3 fields below and click submit. For the disposal type dropdown, select Surplus and in the comments section include the DR # that you were issued by the Surplus System.

Please Note: If another disposal method Is selected, please make sure to attach any supporting documentation to the workday asset. For example, for sale disposals, some form of documentation would need to be attached to the asset which lists out the sales price.

For additional assistance with performing UNIV funded asset processes, please contact Asset Management.

For any questions related to OSP funded capital assets (Tag # starting with "R" or "RF"), please contact OSP Asset Management.

Complete Asset Physical Custody Report (APCR)

Each unit must annually review the Asset Physical Custody Report (APCR), which includes trackable assets. The APCR is certified by the Dean, VP or Senior Fiscal Officer and submitted to Asset Management by the specified deadline.

For additional assistance with performing the annual APCR, contact Asset Management or contact Kim Stephany at the Office of Sponsored Programs for OSP asset assistance.

UNIV/OSP Capital Assets

- Verify accuracy of capital asset information (Location, asset identifier, serial number, etc.) and make any necessary changes in Workday. Each asset must include a location and asset identifier in your review.

- Cost Center Asset Tracking Specialist (CCATS) must enter all applicable updates in Workday with all applicable documentation. Refer to the Update or Make Changes to an Asset job-aid on the Administrative Resource Center (ARC).

- Capital assets that need to be surplused, must be processed through the Surplus Property Management System. For assistance with that process, see Surplus.

- Complete and obtain all appropriate signatures for the APCR Certification Form(s) in DocuSign by the applicable deadline.

UNIV/OSP Non-Capitalized Assets

- Retire any non-capital assets you no longer have or do not wish to track in Workday.

- Verify accuracy of asset information (location, asset identifier, serial number, etc.) and make any necessary changes in Workday.

- Non-capital assets needing to be surplused must be processed through the Surplus Property Management System. For assistance with this process, see Surplus.

- Complete and obtain all appropriate signatures for the APCR Certification Form(s) in DocuSign by the applicable deadline.

Asset Management will conduct risk-based physical counts as prompted (e.g., APCR findings, internal audit). Physical counts of items in research space are given special emphasis, as optimization of the university federal indirect cost rate is dependent upon the accuracy of inventories. Asset Management will schedule counts with the Cost Center Asset Tracking Specialist (CCATS), who are responsible for allowing access to all assets. Asset Management will provide count findings and instructions on how to improve the tracking of assets to the unit leader, senior fiscal officer, and the Cost Center Asset Tracking Specialist (CCATS).

APCR Job Aids, Hints and Additional Information

Email Signature Training

- All CCATS should complete the E-Signature Sender training in BuckeyeLearn which will grant them access to view and use our APCR DocuSign template.

APCR DocuSign Submission Instructions

This attachment explains how to make an APCR Certification Form Submission via the DocuSign website.

Asset Coordinator & Asset Location (Building/Room #) Changes in Workday

- This file explains how CCATS can update each individual asset record in Workday.

- For the asset coordinator field, only active university employees will be accepted. Any assets that currently have an asset coordinator under the retired, terminated, or contingent status will need to be updated in Workday.

Surplus Integration & Tech Hub Invoicing (New Update)

- Please review the Surplus Update document which provides guidance on how to properly surplus trackable Workday assets and explains how the new surplus integration process works.

- In addition, we wanted to communicate that Tech Hub items have started going through the invoicing process as of 10/1/2023.

Office

105 Stores and Receiving Building

2650 Kenny Road

Phone: 614-292-6048

assetmanagement@osu.edu

Monday - Friday

8:00am - 5:00pm