Your payslip can be viewed from the Benefits and Pay Hub app in Workday. All historical paychecks prior to 1/1/21 are also viewable from the Benefits and Pay Hub app by clicking on More Pay Links in the Suggested Links section of the navigation pane.

# | Section | Description |

|---|---|---|

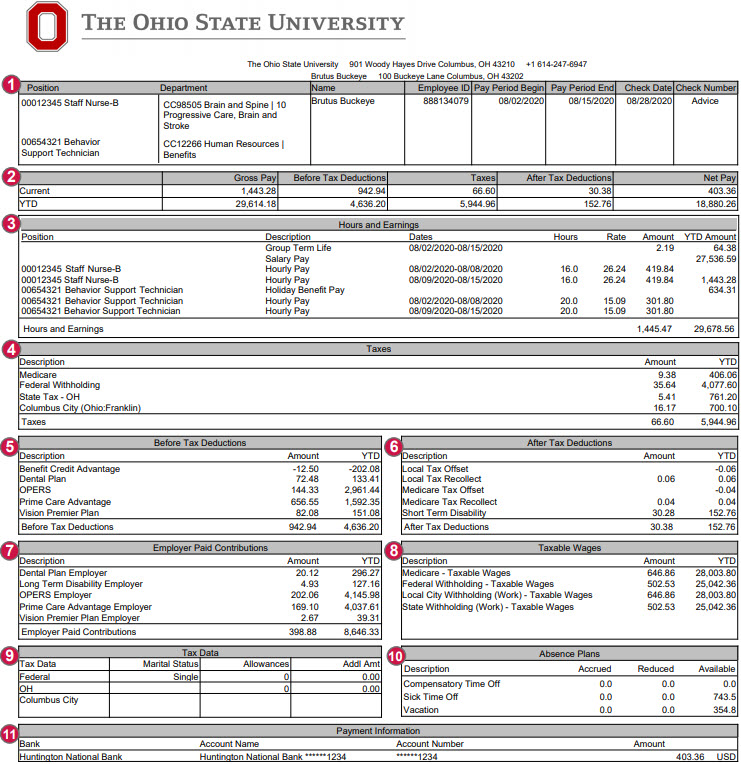

1 | Employee Information | This section lists your Position, Department, Name, Employee ID#, and Pay Period details. Pay Period Begin and Pay Period End dates list the time period for which you are being paid. Check date is the date of payday. Biweekly pay is issued two weeks after the pay period end date. “Advice” in the Check Number box means your pay has been directly deposited to your bank account on file. |

2 | Pay Summary | This section summarizes the current pay period and year-to-date (YTD) amounts for total Gross Pay, Before Tax Deductions withheld, Taxes withheld, After Tax Deductions withheld, and Net Pay. Net pay is the balance of your pay remaining after taxes and deductions are withheld. It is also referred to as your “take-home” pay. |

3 | Hours and Earnings | The Hours and Earnings section lists your earnings information by type for the current pay period and year-to-date (YTD). Rates and Hours (for biweekly employees) and Amounts are displayed. For biweekly employees, the earnings are further broken down within the pay period by FLSA week. Common earnings types include, but are not limited to:

|

4 | Taxes | The Taxes section is an itemization of the taxes that have been withheld for the current pay period and year-to-date (YTD). These can include Medicare, federal, state, local, and other taxes. Resident state taxes are based on your primary Home Address. |

5 | Before Tax Deductions | Before Tax Deductions are subtracted from your earnings before taxes are calculated. Deductions and amounts are listed for the current pay period and year-to-date (YTD). Examples of before-tax deductions include medical, dental, and vision premiums, retirement contributions for the Alternative Retirement Plan (ARP), Ohio Public Employees Retirement System (OPERS) or State Teachers Retirement System (STRS), before-tax retirement service credit purchases, Flexible Spending Account contributions, and parking fees. |

6 | After Tax Deductions | After Tax Deductions are subtracted from your earnings after before-tax deductions and taxes have been subtracted. Deductions and amounts are listed for the current pay period and year-to-date (YTD). Examples of after-tax deductions include donations to eligible charitable organizations, union dues, Child Support withholding, and retirement service credit purchases. |

7 | Employer Paid Contributions | The Employer Paid Contributions section shows the amount that the university contributes towards the cost of your benefits and other required contributions. Costs are listed for the current pay period and year-to-date (YTD). These are NOT deducted from your earnings. |

8 | Taxable Wages | The Taxable Wages section lists the total amount of wages you received on which you were taxed. Amounts may be different as each withholding type has certain qualifications to determine whether wages are taxable. |

9 | Tax Data | The Tax Data section includes your tax withholding elections for federal and state tax, including your marital tax filing status, the number of allowances you have elected (for 2019 or earlier W-4), and any additional tax amounts you requested to be withheld (for employees hired/rehired after 1/1/20, the default value is Single or Married filing Separately with no adjustments). Your work locality is displayed here as well. |

10 | Absence Plans | The Absence Plans section displays accrued, reduced, and available vacation, sick, and compensatory time off balances as of the end of the pay period that you are eligible for. This does not include requested or approved future-dated absence requests. The Absence Plans section is accurate for all employees, including Health System employees. All employees can see the most current absence balance information in Workday Absence. Note: All employees accrue on a biweekly schedule, not on a monthly basis. Monthly-paid employees see information represented for the biweekly pay period end dates that fall within the month being paid, not based on the work days in the month. |

11 | Payment Information | The Payment Information section displays the accounts you have elected for your direct deposit, including the name of your financial institution, the account name, the last 4 digits of your account number, and the amount deposited into your account(s). |