Process

*NOT associated with billing from a Workday Customer Invoice

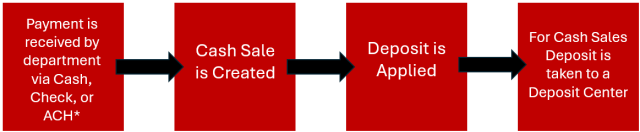

1. Check payments should be recorded in your department’s check log. Collect any cash and place into a deposit bag. Prepare your deposit ticket. Checks may also need to go to a deposit center if your unit does not have a check scanner.

2. A Customer Payment Specialist will initiate the Cash Sale in Workday. If applicable the Customer Payment Specialist the deposit bag number and your deposit ticket.

3. Deposits should be taken to an OSU Deposit Center.

Roles and Responsibilities Associated with Cash Sale

| Role | Responsibility |

|---|---|

| Customer Deposit Specialist | Allows users the ability to review deposit information in Workday. |

| Customer Payment Specialist | Initiates and enters Cash Sale transactions in Workday. |

| Treasury | Issues deposit tickets and supports reconciliation. |

| Department Staff | Collects funds, maintains deposit logs, and ensures accurate categorization. |

| Bursar’s Office | Manages A/R eCommerce platform and handles online payments tied to Customer Invoices. |

Key Reports Associated with Cash Sale

| Report Name | Purpose |

|---|---|

| Find Customer Deposits (Workday Delivered Report) | Shows deposits applied to invoices or Cash Sales. |

| Find Journal Lines – OSU – Posted Journals by Amount | Returns all posted journal line activity by amount type. |

| Managerial Balance Sheet | Shows asset, liability, and equity balances in managerial format. |

| Trial Balance | Displays beginning balance, credits, debits, and ending balance for General Ledger Activity. |

| Revenue Category Report | Available in Workday; shows all FDM values and revenue categories |

| Find Cash Sale Details – OSU | Returns one per Cash Sale Line; requires at least one Worktag.

|

Notable Information for Cash Sale

- Always use CST-0003239 Cash Sale as the customer unless directed otherwise.

- Common Revenue Categories:

- RC1075 – Non-Accounts Receivable

- RC1721 – External Accounts Receivable

- RC1537 – Cash Advance Repayment

- RC1722 – Expenditure Recovery

- Separate Cash Sales must be created for cash and check deposits

You should always check the ‘Create Deposits’ checkbox when creating a cash sale. If you do not check this box, the system records to Undeposited Payments (12130) and you must complete a Workday Create Deposit step to finish the process.

- Ensure timely deposits in compliance with university policy.

- Sensitive financial data (e.g., check images) must not be uploaded to Workday.

- Save yourself time - in the Tax Section notate your sales tax collection. This saves you a step later down the line for recording tax liabilities.

- Upload Check Log (do not attach sensitive info like check images)

- To View Accounting associated with your cash sale:

- Click on the three dots to the right of the Transaction ID. This is called Related Actions button.

- Click View Accounting

A Cash Sale is the workday process used to record cash, check, ACH, or wire payment deposits that are not associated with a Workday Customer Invoice.

Do not use the Cash Sale Business Process to record:

- Credit card terminal or merchant account activity (these post via automated journals).

- Payments tied to Workday Customer Invoices (handled through the Bursar’s A/R eCommerce platform).

- All Deposits must comply with the Deposits of Funds Policy and be recorded promptly.