The Ohio State University uses a paperless system for all paychecks and pay stub information. All faculty, staff and student employees can receive their pay stub information online.

Resources

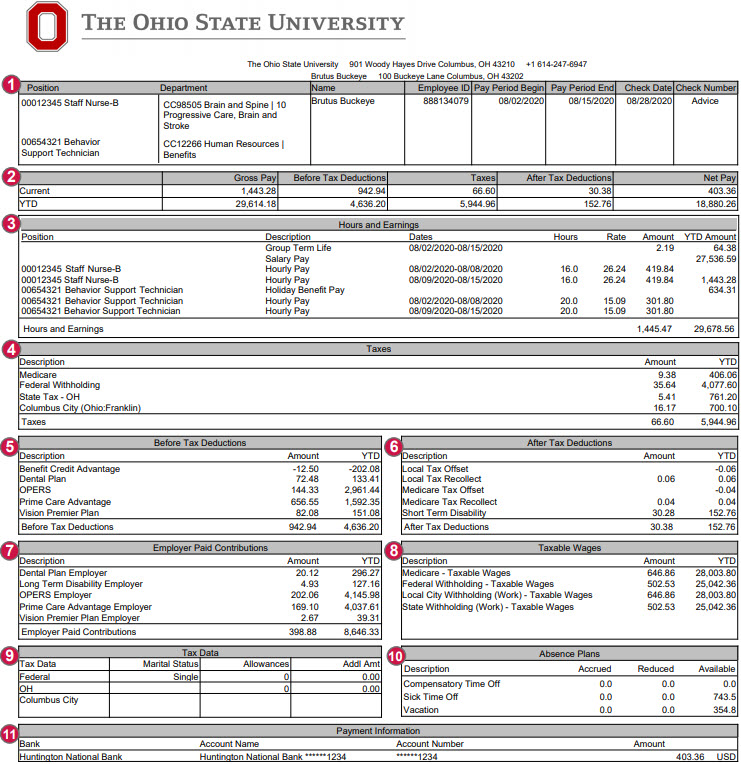

Understanding My Payslip Prior to 2021

# | Section | Description |

|---|---|---|

1 | Employee Information | This section lists your employee ID#, Pay Group, and if you are eligible (non-exempt) for overtime or not eligible (exempt). It also lists your Business Unit. |

2 | Pay Dates | Pay Period Begin and End Dates list the time period for which you are being paid. Biweekly pay is issued two weeks after the pay period end date. Check Number is displayed for all payments, but is only utilized by employees who are receiving a paper check. Otherwise, it is an internal tracking number for Direct Deposits. Check date is the date of payday. |

3 | Tax Data | The Tax Data section includes your tax withholding elections for Federal and State tax. This includes your marital tax filing status, the number of allowances you have elected, and any additional tax amounts you requested to be withheld (defaulted values are Single with 0 allowances). Your work locality is displayed here as well (resident and school district localities will also display if elected). |

4 | Hours and Earnings | The Hours and Earnings section lists your earnings information by type for the Current Pay Period and Year-to-Date. Rate, Hours, and Earnings are displayed. Earnings types include, but are not limited to:

|

5 | Taxes | The Taxes section is an itemization of the taxes that have been withheld for the Current Pay Period and/or Year-to-Date. These can include Federal, State, School District, Local, and FICA Medicare Hospitalization Insurance Tax. |

6 | Before-Tax Deductions | Before-Tax Deductions are subtracted from your earnings before taxes are calculated and subtracted. Deductions and amounts are listed for the Current Pay Period and Year-to-Date. Examples of Before-tax deductions include medical, dental and vision premiums, retirement contributions for the Alternative Retirement Plan (ARP), Public Employees Retirement System (PERS) or State Teachers Retirement System (STRS), Before-tax retirement service credit purchases, Flexible Spending Account contributions and Parking Fees. See Deductions and Mandatory Garnishments for additional information. |

7 | After-Tax Deductions | After-Tax Deductions are subtracted from your earnings after the Before-Tax Deductions and taxes have been subtracted. Deductions and amounts are listed for the Current Pay Period and Year-to-Date. Examples of After-tax deductions include donations to eligible charitable organizations, union dues, Child Support withholding and retirement service credit purchases. See Deductions and Mandatory Garnishments for more information. |

8 | Employer-Paid Benefits | The Employer-Paid Benefits section shows you the University’s cost for your benefits. Costs are listed for the Current Pay Period and Year-to-Date. These are NOT deducted from your earnings. For employees with a taxable amount of Group Term Life Insurance (GTLI), it is displayed in this box as Group Life and is added to your taxable gross income. |

9 | Summary | This summary section shows the Current Pay Period and Year-to-Date amounts for Total Gross Pay, Federal Taxable Gross Pay, Total Taxes withheld, Total Deductions withheld, and Total Net Pay. Total Gross may not match the Total Earnings in Box 4 on your paystub due to taxable fringe benefits. |

10 | Net Pay | Net pay is the balance of your pay remaining after taxes and deductions are withheld. It is also referred to as your “take-home” pay. |

11 | Leave Balance | The Leave Balance section displays Current and Year-to-Date vacation, sick time, compensatory time and military leave balances. All employees will have 176 hours of military time listed initially, but only service members on active duty may use it. Wexner Medical Center employees will not have their balances displayed here, instead, they will need to login to OneSource. |

12 | Net Pay Distribution | The Net Pay Distribution section displays the method in which you receive your pay. If you are enrolled in direct deposit, the account type, name of the financial institution, and the last four (4) digits of the account number are displayed, as well as the amount deposited into your account/s. If you receive a paper check, the check number (also seen in Box 2) will be displayed and indicate Issue Check. |

Additional Payslip Information

- Employees with both a fellow (non-employee) and non-fellow (employee) position will always receive two payslips from Workday - one payslip for each position on the appropriate pay schedule, rather than one combined payslip.

- There may be occasions where an employee receives two separate payslips for a pay period, resulting in two separate deposits into their bank account. This is typically a one-time occurrence when certain changes are made in Workday and will not occur on a regular basis.

Garnishment

A garnishment is a court order that requires the university to withhold money from your paycheck to be paid to a debtor. Wages can be garnished because of debts to creditors, federal and state tax levies, or alimony and child support.

There are two ways you will know that there are garnishments to your paycheck. First, you should receive notification from an agency or court that your wages will be garnished. Secondly, you will be able to see the garnishments itemized on your paycheck.

- Child Support - The appropriate County Child Support Enforcement Agency or court will send the university an order if you have had a new child support order filed or a change on a current order.

- Chapter 13 Bankruptcy - This type of garnishment stops all creditors that are listed in your filing agreement with the Chapter 13 Trustees from garnishing your checks (stops creditor garnishment only).

- Creditor Garnishment - Any Court, Civil Court or Common Pleas Courts can require the university to garnish your paycheck as a result of a court judgement.

- IRS Tax Levies - The Internal Revenue Service (IRS) can garnish your paycheck for tax levies the IRS has filed for any purpose such as taxes owed for property and back taxes. If you are married, the filing may be made on whichever person is employed by The Ohio State University.

- Student Loan - The Student Loan Guarantor sends notification to garnish your paycheck if you are in default on your student loan.

- Consumer Credit Counseling - This is a contractual agreement between you, the debtor, and creditors, to pay an agreed upon amount either monthly or biweekly.

- IRS Payroll Deduction Agreements - This is a contractual agreement between you, the debtor, and creditors, to pay an agreed upon amount either monthly or biweekly.

Lump Sum Payments and Child Support Orders:

As an income payer, the university is required to report lump sum payments to child support agencies to review child support arrears and allow response time. If you have a child support order and are expecting a lump sum payment, the lump sum will be paid on your next available paycheck after (a) we receive a response from the child support agency or (b) 30 days expires from when we sent the lump sum notice to the child support agency, whichever comes first.

Deductions - COTA

Employee COTA Bus Access Election Instructions:

- Log in to Workday

- Select the Benefits and Pay Hub app.

- Click on Pay, then select Voluntary Deductions.

- Select COTA Bus Access as the Deduction, click Add

- Frequency: defaults to Ongoing

- Pay Cycle Frequency: defaults to the employee’s pay frequency (Monthly or Biweekly). For Biweekly, the deduction is only withheld on the 2nd payday of the month.

- Start Date: Enter the date for the deduction to begin. NOTE: The deduction withheld provides the employee with a bus pass for the following month. For example, a deduction is withheld on a March check date will provide the rider with a bus pass for the month of April.

- End Date: Enter the date for the deduction to end. This date is the last day you want the deduction to come out of your paycheck, not the date you want to stop riding COTA. This is not a required field; however, the deduction will continue until the employee enters an End Date. NOTE: Once the deduction stops being withheld, your access to ride the bus will stop at the end of the following month. For example, your last deduction was withheld in June, and there was no deduction in July, your access to ride the bus will stop July 31.

- Next Payment Date: This field automatically populates

- Type: Defaults to Amount

- Value: Defaults to the current amount of $58

Deductions

Payroll deductions are wages withheld from your total earnings and are before-tax or after-tax. Some deductions, like charitable contributions, are voluntary for programs or services that you choose to purchase or participate in and others, like taxes, are required by law.

Deductions taken from your paycheck before taxes include:

- Medical, dental, and vision plan premiums you have elected to purchase

- Required retirement contributions to the Alternative Retirement Plan (ARP), Ohio Public Employees Retirement System (OPERS), or State Teachers Retirement System (STRS)

- Voluntary contributions to 403(b) and 457 Supplemental Retirement Accounts

- Voluntary contributions to Flexible Spending Account(s)

- Fees for campus parking passes purchased

- Other deductions (i.e. pre-tax retirement service credit purchases)

Deductions taken from your paycheck after taxes include:

- Union dues

- Charitable donations you choose to make through payroll deductions for the Campus Campaign, the Community Charitable Drive or other charity drives

- Life insurance you choose to purchase

- Other deductions (i.e. after-tax retirement service credit purchases)

Taxes taken from your paycheck as deductions:

- Federal

- State

- Local

- School Tax

- Medicare

Note: university employees do not pay into Social Security. However, university employees hired on or after 4/1/86 are required to pay the medicare portion of Social Security.

Employees who have completed the Your Plan for Health (YP4H) Personal Health Assessment (PHA) will see a credit for “Benefit Choice” or “Benefit Advantage” on their payslip issued as a negative deduction.

Monthly Payslip Overview

- Regular base wages are reported as Salary Pay, Academic Pay, Activity Pay, or Fellowship Stipend depending on job classification.

- Most monthly employees will see Holiday Benefit Pay and pay for other types of Time Off listed separate from Salary Pay. However, Paid Time Off earnings do not display on the payslip for “Associated Faculty – Semester”, “Graduate Associate”, and “Other Fellow/Trainee” employees.

- All employees who receive Certification Pay will see it displayed separately as its own line item.

- If an earning type appears multiple times in the “Hours and Earnings” section, employees will only see the YTD Amount value for that earning type displayed on one line. The amount shown will be the total of all earnings from that earning type.

- For One-Time Payments, such as a bonus or other lump sum payment types, employees will see dates in the Hours and Earnings section of their payslip. Although these dates may differ from the Pay Period Begin and End dates, the payment will be paid in full on the payslip check date. The dates that appear in this section of the payslip for One-Time Payments do not have any impact on the payment or the employee. For more information about the One-Time Payment, visit your Worker Profile, click Job, then Worker History. Click View Worker History by Category, and then click on the Compensation tab.

- Employees with multiple positions will not see YTD Hour values in the “Hours and Earnings” section of the payslip.

Biweekly Payslip Earnings

- Regular base wages are reported as Hourly Pay.

- Additional premium pay amounts for shift differential, weekend differential, certification pay, clinical ladder pay, charge pay, and overpercent are reported as a separate line item from the base hourly, time off, holiday, and overtime wages.

- For the Overtime and Holiday Worked earning types, the hourly rate displayed on the payslip will not reflect the rate that was used to calculate the payment. The base hourly rate will display on the payslip, but the dollar amounts for Overtime and Holiday Worked earnings will calculate based on the premium hourly rate for each earning type. This is a display nuance only and does not impact net pay.

- All employees who receive Certification Pay will see it displayed separately as its own line item.

- For those receiving Clinical Ladder pay, the payment will display as an allowance earning separate from Hourly Pay.

- If an earning type appears multiple times in the “Hours and Earnings” section, employees will only see the YTD Amount value for that earning type displayed on one line. The amount shown will be the total of all earnings from that earning type.

- For One-Time Payments, such as a bonus or other lump sum payment types, employees will see dates in the Hours and Earnings section of their payslip. Although these dates may differ from the Pay Period Begin and End dates, the payment will be paid in full on the payslip check date. The dates that appear in this section of the payslip for One-Time Payments do not have any impact on the payment or the employee. For more information about the One-Time Payment, visit your Worker Profile, click Job, then Worker History. Click View Worker History by Category, and then click on the Compensation tab.

- Employees with multiple positions will not see YTD Hour values in the “Hours and Earnings” section of the payslip.

Payslip Overview

Your payslip can be viewed from the Benefits and Pay Hub app in Workday. All historical paychecks prior to 1/1/21 are also viewable from the Benefits and Pay Hub app by clicking on More Pay Links in the Suggested Links section of the navigation pane.

# | Section | Description |

|---|---|---|

1 | Employee Information | This section lists your Position, Department, Name, Employee ID#, and Pay Period details. Pay Period Begin and Pay Period End dates list the time period for which you are being paid. Check date is the date of payday. Biweekly pay is issued two weeks after the pay period end date. “Advice” in the Check Number box means your pay has been directly deposited to your bank account on file. |

2 | Pay Summary | This section summarizes the current pay period and year-to-date (YTD) amounts for total Gross Pay, Before Tax Deductions withheld, Taxes withheld, After Tax Deductions withheld, and Net Pay. Net pay is the balance of your pay remaining after taxes and deductions are withheld. It is also referred to as your “take-home” pay. |

3 | Hours and Earnings | The Hours and Earnings section lists your earnings information by type for the current pay period and year-to-date (YTD). Rates and Hours (for biweekly employees) and Amounts are displayed. For biweekly employees, the earnings are further broken down within the pay period by FLSA week. Common earnings types include, but are not limited to:

|

4 | Taxes | The Taxes section is an itemization of the taxes that have been withheld for the current pay period and year-to-date (YTD). These can include Medicare, federal, state, local, and other taxes. Resident state taxes are based on your primary Home Address. |

5 | Before Tax Deductions | Before Tax Deductions are subtracted from your earnings before taxes are calculated. Deductions and amounts are listed for the current pay period and year-to-date (YTD). Examples of before-tax deductions include medical, dental, and vision premiums, retirement contributions for the Alternative Retirement Plan (ARP), Ohio Public Employees Retirement System (OPERS) or State Teachers Retirement System (STRS), before-tax retirement service credit purchases, Flexible Spending Account contributions, and parking fees. |

6 | After Tax Deductions | After Tax Deductions are subtracted from your earnings after before-tax deductions and taxes have been subtracted. Deductions and amounts are listed for the current pay period and year-to-date (YTD). Examples of after-tax deductions include donations to eligible charitable organizations, union dues, Child Support withholding, and retirement service credit purchases. |

7 | Employer Paid Contributions | The Employer Paid Contributions section shows the amount that the university contributes towards the cost of your benefits and other required contributions. Costs are listed for the current pay period and year-to-date (YTD). These are NOT deducted from your earnings. |

8 | Taxable Wages | The Taxable Wages section lists the total amount of wages you received on which you were taxed. Amounts may be different as each withholding type has certain qualifications to determine whether wages are taxable. |

9 | Tax Data | The Tax Data section includes your tax withholding elections for federal and state tax, including your marital tax filing status, the number of allowances you have elected (for 2019 or earlier W-4), and any additional tax amounts you requested to be withheld (for employees hired/rehired after 1/1/20, the default value is Single or Married filing Separately with no adjustments). Your work locality is displayed here as well. |

10 | Absence Plans | The Absence Plans section displays accrued, reduced, and available vacation, sick, and compensatory time off balances as of the end of the pay period that you are eligible for. This does not include requested or approved future-dated absence requests. The Absence Plans section is accurate for all employees, including Health System employees. All employees can see the most current absence balance information in Workday Absence. Note: All employees accrue on a biweekly schedule, not on a monthly basis. Monthly-paid employees see information represented for the biweekly pay period end dates that fall within the month being paid, not based on the work days in the month. |

11 | Payment Information | The Payment Information section displays the accounts you have elected for your direct deposit, including the name of your financial institution, the account name, the last 4 digits of your account number, and the amount deposited into your account(s). |