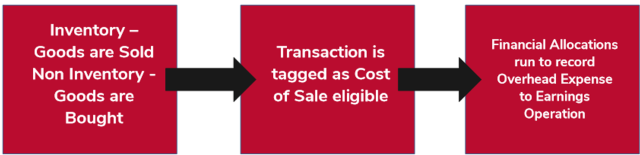

Process

Items qualifying for Cost of Sales are bought/sold:

Examples Include:

- Fuels and additives used in production/distribution

- Services tied directly to resale operations

- Supplies for resale

- Food for Student Life Dining Halls

Transactions are tagged as Cost of Sales eligible:

For Non Inventory Items:

- Use Earnings Operation worktags when buying your goods/services.

- Tag your non inventory transaction with Expenditure Treatment ET101: Cost of Sales at the requisition, PCard, or payment step.

- Use an appropriate Spend Category for what you purchased (e.g., lab supplies.)

- This ensures correct tagging to Ledger Account 61020: Cost of Sales.

For non-Workday managed inventory:

- Use ET131 at the time you are making your purchases and ensure you have selected a stockable spend category.

- Upon sale of inventory, create a Cost Center Journal where you:

- Credit: 15000 (Inventory)

- Debit: 61020 (Cost of Sales)

Central Allocations are run and overhead is charged to the earnings operation.

- Overhead is charged monthly on business day 5 of close via journal source “Allocation”.

- Overhead is posted to 66110: University Overhead (SC10783)

Roles and Responsibilities Associated with Cost of Sales and Overhead

| Role | Responsibility |

|---|---|

| Purchase Initiator | Makes the purchase, documents business purpose, and applies correct tags (ET101, Earnings Fund, Spend Category). |

| Cost Center Manager | Reviews and ensures correct FDM values are used based on business purpose. |

| FP&A and Controller’s Office | Monitors ET101 usage and enforces compliance. Improper use may result in penalties. |

| Earnings Operation Staff | Ensures revenue and expenses are recorded promptly and accurately. |

Trainings, Job Aids, and Resources

(BuckeyeLearn) | Explains what items qualify as Cost of Sales, and how to ensure expenses are properly classified as Cost of Sales in the General Ledger. |

(BuckeyeLearn) | Explains how Cost of Sales impacts overhead charges for Earnings Operations. |

Key Reports Associated with Cost of Sales and Overhead

| Report Name | Purpose |

|---|---|

| Sources and Uses Variance Analysis | High-level income statement including revenue and expenses for an Earnings Operation. Can be used to drill-down to COS ledger account and Overhead ledger account activity. |

| Equity Balances by Balancing Carry Forward Worktags | Financial summary with drill-down to COS and Overhead. |

| Find Journal Lines – OSU – Posted Journals by Amount Type | Exports all posted journal line activity. Can be used to review Revenue, Cost of Sale or Overhead expenses for an earnings operation. |

Notable Information for the Process

Cost of Sales (COS) refers to goods and services purchased for resale or direct pass-through. Properly tagging transactions with Cost of Sales will ensure your unit is correctly paying overhead. Transactions must be tagged correctly using Expenditure Treatment ET101 and appropriate other worktags to ensure accurate financial reporting.

Overhead is a monthly charge applied to earnings operations. Overhead is a proportional charge to earnings operations for central services (e.g., accounting, police, snow removal). Overhead rates vary by operation type and are published annually by FP&A.

- Revenue & Expenses for your earnings operation must be recorded in FD120, FD121, FD122, or FD200

- Overhead is calculated on gross revenue minus COS. Incorrect tagging items with Cost of Sales, increases your Earnings Operation’s overhead charges.

- Overhead Rates are reviewed annually and published by FP&A.

- Refunds/Rebates should be recorded as a Cash Sale to offset Cost Of Sale. Use RC1722 (Expenditure Recovery), ET101, and a COS-eligible spend category.

To correct Overhead you would need to consider the following:

- If a PO hasn’t been billed: update worktags via Change Order.

If billed: use Accounting Adjustment or Cost Center Journal.

- Corrections must be made before fiscal year-end and cannot cross fiscal years.

- ET101 Cost of Sales usage is monitored by FP&A and the Controller’s Office. Misuse may result in the Unit being required to repay under collected overhead and loss of earnings operation status.

- Overhead Calculation:

- Step 1: Revenue × Overhead Rate

- Step 2: Cost of Sales × Overhead Rate

- Final Charge = Step 1 – Step 2